Subscribe to CleanTechnica’s Weekly Substack for comprehensive analyses and high-level summaries from Zach and Scott, sign up for our daily newsletter, and/or follow us on Google News!

Last Updated on: 12th April 2025, 08:22 pm

The Northern Lights carbon capture and storage endeavor is frequently categorized as a logistics operation, though fundamentally, it serves as a storage facility. The Øygarden terminal, along with its connecting offshore pipeline and the Johansen Formation, comprises the infrastructure that converts cross-border CO₂ shipments into permanent geological storage. Phase 1 is not merely a study or a strategic plan. It is a built facility equipped with injection-ready wells, a pressurized and monitored seabed pipeline, and an onshore buffer system intended to receive, re-pressurize, and inject 1.5 million tons of carbon dioxide annually. While the emitters may differ and the vessels may advance, this segment of the system is meant to be enduring.

This piece is part of a brief series on Northern Lights. In the initial article, I examined the clients undertaking carbon capture. BASF’s recent decision to withdraw from a shipping and storage arrangement for its Antwerp-based Kairos@C project highlights the core challenge: even when the engineering is robust, the financial viability remains weak.

Phase 1 of Northern Lights is currently fully subscribed, yet only through a combination of government-supported Norwegian projects, EU-funded BECCS initiatives, and one cost-effective industrial emitter—Yara—situated ideally with a pure CO₂ supply. Capture costs for the majority of participants still exceed €100 per ton, with some instances approaching or surpassing €150 per ton. The economics simply do not align based solely on carbon pricing. Even in the most favorable scenarios—where capture sites are near water, liquefaction occurs on-site, and shipping distances are manageable—the necessity for subsidies persists. One emitter outside a port capable of accommodating the ships intends to develop a pipeline, which I believe is unlikely to receive approval, and is currently transporting 20 tons at a time over 100 km to a waterfront facility. Phase 2 would necessitate a fivefold increase, and there’s scant evidence thus far that this model can be duplicated without even greater public backing or a significantly elevated carbon price.

In the second article, my focus shifted to the maritime transport framework central to Northern Lights—a fleet of specially-designed CO₂ carriers linking emitters in Norway, Denmark, the Netherlands, and Sweden to the Øygarden storage terminal on Norway’s western coast. From an engineering standpoint, the system is cutting-edge: involving cryogenic tanks, LNG propulsion, wind-assisted rotor sails, and meticulous integration with port and storage infrastructure. Yet, from an economic and scalability perspective, it remains a precarious and expensive solution to a problem we ideally should be addressing upstream.

Each vessel transports approximately 6,500 to 7,000 tons of liquefied CO₂ per journey in Phase 1, whereas planned Phase 2 ships will expand that capacity to between 12,500 to 20,000 m³. Nevertheless, the costs associated with maritime transport—including capital, operations, LNG fuel, and emissions—contribute approximately €30 per ton to the overall CCS process. With only a limited number of vessels in operation, the system depends heavily on precisely timed schedules and provides minimal room for mistakes. Delays at sea or bottlenecks at terminals can rapidly lead to backlogs at emitter locations, which all maintain CO₂ in buffer tanks on-site. As distances extend in Phase 2—Stockholm to Øygarden is nearly 2,000 km for a round trip—the logistics become increasingly fragile and ship emissions escalate, yielding 30,000 to 50,000 tons of CO₂ annually solely from propulsion.

Norway has financed 80% of the capital expenditure for this fleet and the storage facility via its sovereign wealth fund. Nevertheless, the economic outlook remains precarious. Unlike pipelines, vessels necessitate continuous fueling, docking, navigational routing, and staffing. Each emitter requires its own liquefaction facility, and every port needs its customized cryogenic loadout. This is not a replicable framework—it is a specialized workaround. While it renders Northern Lights feasible in the short term, the long-term trajectory is already evident: emitters such as Yara are exploring alternatives connected by pipelines with lower lifetime costs.

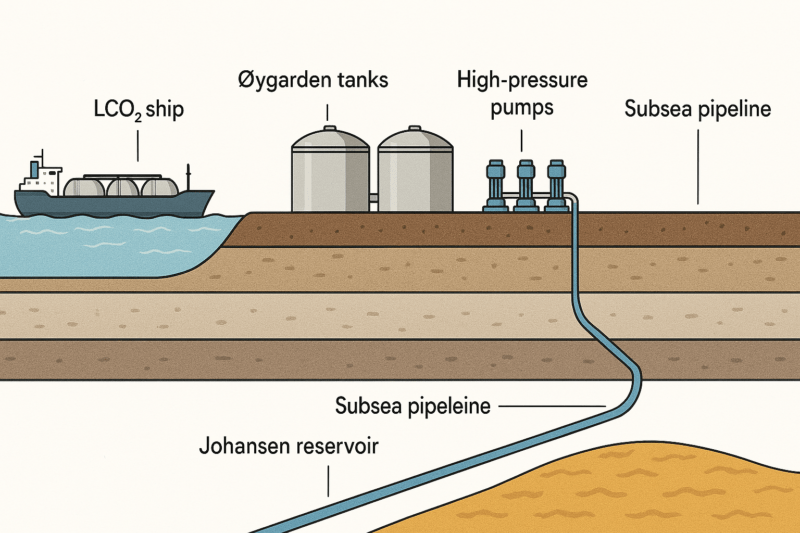

Thus, we turn to the sequestration site to which the vessels are making their way. The Øygarden terminal is located along the rugged coastline of western Norway, nestled in the industrial zone adjacent to the fjord north of Bergen. In Phase 1, it features twelve cylindrical buffer tanks, each capable of holding around 625 cubic meters, totaling 7,500 cubic meters of storage capacity. This volume corresponds to one complete shipment from a 7,500 m³ liquefied CO₂ carrier. The tanks are designed to retain liquid CO₂ at roughly –26 °C and 15–19 bar. Insulated and pressurized, they facilitate the transition from marine delivery to pipeline injection. Upon a vessel’s arrival, the CO₂ is offloaded via cryogenic transfer arms, integrating into the buffer system. It is subsequently pumped to higher pressures, measured, and then channeled into the subsea pipeline under injection conditions—approximately 110 to 150 bar depending on depth, temperature, and desired flow rate. The site incorporates real-time monitoring for pressure, temperature, composition, and flow.

The offshore pipeline extends about 100 kilometers, terminating in the Johansen Formation beneath the North Sea. It is a steel pipeline between 12 to 16 inches in diameter, internally coated to accommodate dry CO₂ and designed to withstand ductile rupture during decompression or phase changes. The pipeline transports CO₂ in a dense phase—not entirely liquid, nor gaseous, but supercritical. Temperature and pressure are upheld throughout the pipeline to prevent transitions that may disrupt flow. The burial depth and routing are selected to minimize risks associated with trawling, anchor strikes, or seabed alterations. Operational flow rates are configured to align with injection wellhead pressure and reservoir absorption capacity, estimated to be in the tens of millions of tons.

The injection target is the Johansen Formation, a substantial layer of porous sandstone located roughly 2,600 meters beneath sea level. It is shielded by a dense shale caprock and bordered by additional geological structures that hinder upward migration. Seismic assessments, stratigraphic modeling, and reservoir simulations have verified its appropriateness for long-term storage. The injected CO₂ will fill pore spaces in brine-saturated rock, promoting lateral spreading and gradual dissolution. Northern Lights has pledged to proactive monitoring, including seismic surveys, pressure readings, and geochemical tracers, to confirm plume movement and containment. The wells themselves are steel-cased, cemented, and equipped with packers and safety valves. The anticipated active injection duration is between 20 to 30 years, followed by an additional multi-decade post-closure monitoring interval in accordance with the EU CCS Directive.

The operational system is as sophisticated, efficient, and engineered as feasible for a long-duration waste containment solution. However, it is not easily duplicated. The Øygarden location presents a unique combination of deepwater port access, short offshore distance to storage, stable geology, and permitting governed by a single national authority. The financial outlay required to develop the onshore terminal, offshore pipeline, and wells is considerable—estimated to exceed 700 million USD for Phase 1. The injection formation is well-characterized, among many in Europe, but most are not as readily accessible. The throughput of the system is constrained by the number of ships it can accommodate, the storage volume it can manage, and the wells’ capacity. Expanding beyond Phase 1 necessitates new wells and additional tanks,and additional storage at emitter locations. None of these expenses scale efficiently.

Even if Phase 2 advances, the Øygarden terminal will continue to be the sole injection point. It lacks a connection to a larger network. There is no continental pipeline supplying it. Each emitter must independently address liquefaction, storage, and scheduling. The pipeline linking the terminal to the reservoir is sturdy, but it is brief. It cannot support new paths. It lacks the capacity for geographical expansion. It serves solely as a terminus. The facility might function for many years and could remain an effective carbon sink. However, it is not a template for expanding CCS in Europe. It operates in a closed loop with restricted reach, and every ton of CO₂ it sequesters will remain reliant on maritime logistics until a wider network is established—if that ever occurs.

Even with the Norwegian government subsidizing 80% of the capital expenditures for Northern Lights Phase 1, the expense of underground carbon storage at Øygarden stays considerable. When subsidies reduce the project’s initial capital investment from €700 million to merely €140 million paid by the operator, and annual operational expenses still range from €28 to €35 million per year over 25 years, the fully inclusive cost of storage hovers between €22 and €27 per ton of CO₂. That amount is solely for the terminal, the offshore pipeline, and the injection wells—excluding the costs associated with capture, purification, liquefaction, or marine transport. For emitters, it represents a tangible expense—one they must either absorb or transfer, even in an optimal subsidy scenario. Although the Norwegian state may be financing the infrastructure, the financial rationale still relies on someone paying over €20 per ton merely to cause carbon to vanish into stone. This is in addition to the steep costs of capture, cleansing, liquefaction, and buffering storage for prime, waterside locations, followed by conveyance.

Without the 80% capital expenditure subsidies, the highly advantageous site would charge twice as much for sequestration. Other locations, often significantly farther offshore, will incur increased costs. The expenses associated with CCS are becoming quite apparent, and I suspect its prospects are considerably more constrained than the fossil fuel sector has been asserting.

Regardless of your solar power status, we invite you to participate in our latest solar power survey.

Have insight for CleanTechnica? Interested in advertising? Would you like to recommend a guest for our CleanTech Talk podcast? Get in touch with us here.

Sign up for our daily newsletter to receive 15 fresh cleantech articles daily. Alternatively, subscribe to our weekly newsletter if daily updates are too frequent.

CleanTechnica employs affiliate links. Review our policy here.

CleanTechnica’s Comment Policy