The Intend To Accelerate Renewables Fostering

Renewables are increasing rapidly as a share of newest electric age, nonetheless are however being taken in also gradually as well as however stand for also little of a portion of full age, to have the capability to change quickly adequate to scale right into a reduced carbon financial system in time to alleviate regional weather condition adjustment.

The problem of using public aid, with aids as well as various reallocation methods, is a politically billed subject. Too much carbon supporters, for example American Oil Institute, says that aid for renewables misshapes the marketplace. It has actually been suggested, for circumstances by the IMF, that aids for leading carbon markets are so prevalent, approximated for 2015 at US$ 5.3 trillion (6.5% of worldwide GDP) that not only is the market altered nonetheless federal governments are efficiently caught. This conflict will not be fixed within the near to period, nonetheless the “market” will certainly continue to respond, as has actually been seen by the significant discount rate in costs for solar {equipment} as well as batteries.

Resources Building And Construction as well as Worth

Structuring the deals to incentivize the resources markets to reduce funding as well as various “tender” costs is the path that might practically certainly add to increasing ongoing development. The marketplace, in wide strokes, includes 3 common groups: 1) endeavor contractors ( Enrollers) that coordinate endeavor financing to finance preparation, style, purchase, permitting, etc. 2) surface consumers of the created power ( Off takers) which symbolize primary energies, substantial service commercial business, towns, colleges, etc. 3) as well as possession owners ( Profile funds), which buy achieved jobs to work, disperse profits, as well as are fixated internet return. Threat Reduction determines concentrated at every transactional node might likewise be among the easiest means to accelerate the ascendancy of renewables.

Enrollers should take care of costs to have the capability to contend as electric power vendors, to have the capability to supply a hostile rates to the Offtakers. Threat reduction on the endeavor phase involves diverse sorts of insurance policy protection against a selection of added extensive risks, for example with performance bonds. Complete overviews might be found Danger Reduction Referral Overview for New Power Funding, by Energi, Taking Care Of the Danger in Renewable Resource by Economic Expert, as well as Opening Renewable Resource Financial investment: The function of danger reduction as well as structured financing by IRENA Among lots of significant risks is offtake risk, as well as changes in earnings from intermittency arising from environment connected reasons. Another risk is stated to the costs of onset endeavor funding in tax obligation justness collaborations, that are structured to increase the benefits of utilizing moneying tax obligation debt, to supply a concentrated return, after which, a flip in belongings is implemented for the justness associate to departure. A long term assess of Collaboration Flips is presented by a regulation company focusing on eco-friendly tax obligation factors, as well as program of is verified within the representation from NREL.

Offtakers are below pressure to buy eco-friendly age, for a variety of reasons: a) legal requirements from state Renewable Profile Needs (RPS), government discharges suggestions, as well as protected against worth requirements below PURPA; b) as an outcome of brand-new age is valuing reduction than non-renewables, as well as c) as an outcome of there’s increasing involvement by business making dedications to understand 100% eco-friendly power usage.

Each Enrollers & & Offtakers are inspired to trade long term Power Acquire Agreements (PPA’s) to secure rates, which benefits Enrollers by establishing a reliable well worth for earnings to have the capability to service financial debt, as well as for Offtakers in establishing a reliable worth that bushes in resistance to rising cost of living. Within today market, smaller sized Offtakers & & Enrollers are robbed nonetheless increasingly more are being aided by collector suppliers which might aid in working out multi-party PPA’s or electronic PPA’s, such due to the fact that the system established by LevelTen Power system that matches groups of little customers to groups of little wind turbines, or as within the situation including MIT as support offtaker.

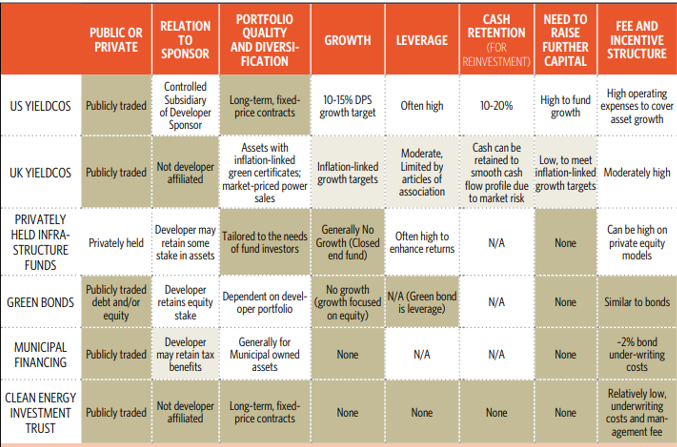

Profile funds are readily available diverse kinds– openly traded yieldcos like NEP, AY, nyld as well as terp, individual facilities funds, unskilled bonds, clear power financing trust funds, etc. They blend functioning eco-friendly jobs, take increased devaluation as well as financing (or production) tax obligation debt, as well as disperses the majority of its profits in rewards, as both individual or openly traded funds, as well as are normally considered a technique for raising resources for eco-friendly development, straight or otherwise straight. Since 2015, RBC Resources Markets approximated that y ieldcos held concerning $32 billion worth of eco-friendly age venture well worth in The United States and Canada, with estimates to create to $500 billion. Extra, it approximated that by 2030, yieldcos could internationally have a feasible possession swimming pool worth above $ 6 trillion A bubble

established for yieldcos that decreased later on in 2015, due partially to over-pricing the jobs gotten as well as appraisals based primarily on returns advancement assumptions. Fund connections to Enrollers differs, in some scenarios, funds have “internal enrollers”, just like energies that kind yieldcos from “fall” jobs placed within the offshoot auto, which supplies help for its security sheet, allowing it to recapitalize brand-new jobs, create incomes, as well as aid cash around for circulation (CAFD).

For Profile funds, risk reduction is taken care of by purchasing jobs packed with enhanced

For Profile funds, risk reduction is taken care of by purchasing jobs packed with enhanced  offtaker rates as well as credit reliability, defense for implementation risks connected to advancement as well as system procedure, as well as increasingly more, packed with reduction approaches for diverse kind of environment as well as indeterminacy connected risk. A main factor to consider for purchases is worth of resources, as well as the property of this last team of risk approaches is that resources costs might be decreased by 100 structure variables or added, which significantly affects bankability of the endeavor.

offtaker rates as well as credit reliability, defense for implementation risks connected to advancement as well as system procedure, as well as increasingly more, packed with reduction approaches for diverse kind of environment as well as indeterminacy connected risk. A main factor to consider for purchases is worth of resources, as well as the property of this last team of risk approaches is that resources costs might be decreased by 100 structure variables or added, which significantly affects bankability of the endeavor.

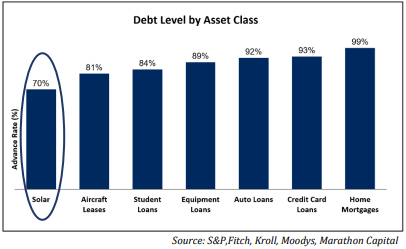

To streamline the mannequin connection in between Enroller as well as Fund, the possession upon conclusion will be packaged, along with the PPA, to integrate long term funding that blends financial debt as well as justness, tax obligation debt, RECs & & carbon debt, with financial debt proportion normally comprising 70% -80%.

Threat reduction might potentially move the Weighted Common Worth of Resources added in instructions of financial debt, at reduction worth than justness, & & extra as long as 1% in return, which in flip, could move the marketplace.

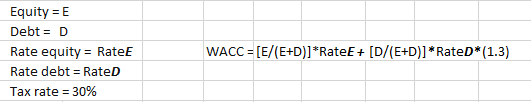

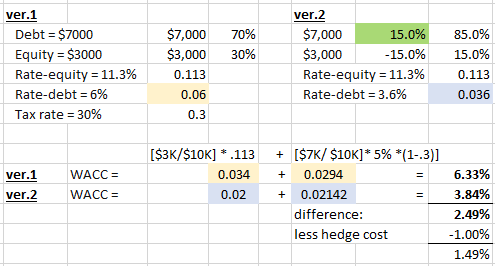

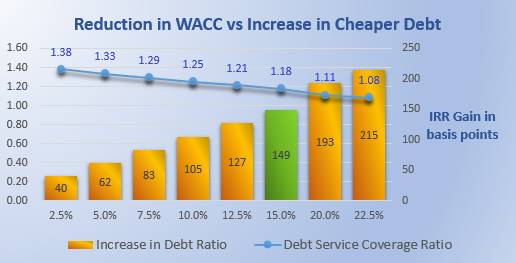

We will certainly see if that may be real, by very first validating {that} change in WACC can get a 1% acquire. Rates for financial debt was reported, since 1 st quarter 2018 as within the differ of 3.6% by one offer monitoring resource, which showed that credit report solutions spreads have actually been within the differ of 130 structure variables (1.3%) over 3-mo LIBOR of 2.3% which = 3.6%. Justness costs spreads have actually been reported to be within the differ of 6-9% over LIBOR which =

8.3%– 11.3%.

Weighted Common Worth of Resources (WACC) is computed as complies with: Ver1 within the circumstances below exposes financial debt proportion starting at 70%, with costs of return at 11.3% for justness, 6% for financial debt. Ver2 changes the proportion by 15%, expanding financial debt, reducing justness, reducing the financial debt rate to 3.6% & & leaving justness rate taken care of at 11.3%. This validates that the difference might wind up in a price cut of WACC by 2.49%, as well as, after netting out the approximated 1% worth of the bush, this translates right into an IRR acquire of 149 structure variables That is within the ball park, when in contrast with a price quote from a swap provider {that} 15% boost in the red create a acquire of 100 basis factors

For referral, a range of financial debt proportion variables are in addition verified against Financial obligation Solution Security Proportion (1.30 stands for 70% financial debt proportion to cash motion to cowl, 1.10 stands for 90%, etc.) Just how do these bushes function, what are the auto mechanics? There are 3 wide ranges of environment risk button: insurance policy protection (as well as reinsurance), swaps as well as by-products, normally made use of in mixes.

Insurance policy protection supplies full defense for reduced opportunity, too much risk events (i.e., typhoons) as in contrast with by-products which provide slim solitary risk defense for leading opportunity, reduced risk events, (i.e., environment, reduced wind, reduced irradiance). Costs as well as payments for by-products are chosen by the market well worth of the underlying valuables not by the opportunity of a loss event taking place. Cases for by-products are much faster, typically paid based primarily upon an activating event against a defined index, whereas negotiation of insurance policy protection insurance claims is normally a lengthy program of due complex assessment of losses.

If a wind ranch underperforms because of a touch of windless days, an offshoot agreement might be structured as a “put” that will certainly be set off if making dips below the “strike,” well worth. One withdraw is that the market for such by-products is skinny, not adequate counterparties which are normally fast wind or daytime, that can develop a need pull by purchasing up these agreements from the pioneers to hedge their really own financial investments. Presently the marketplace includes larger financial facilities (ie., Goldman Sachs as well as various bespoke market manufacturers) & & specialized insurance firms, as well as most likely pure gas wind turbines whose ability aspects reduced when wind power begins the grid. One such provider within the Environment Threat Switch over market, of crossbreed “Insurance policy protection Linked Stocks”, GCube competes that absence of setting reliable as well as pleasant environment risk button within the wind power industry has actually led to stakeholders within your house being entrusted as a great deal as $ 56 billion in untapped possession worths that might be corrected with adequate structuring of risk reduction.

Swaps change risk by trading a variable possession for an established possession, on this situation, an earnings stream with intermittency risk traded for an established quarterly cost. The “supplier” within the swap manages an ensure, to levelize the earnings stream by guaranteeing to guarantee any type of shortage in earnings in alternative for job of the entire incomes. They think about the risks of long-lasting shortage with comprehensive actuarial assessment of environment data sources, to approximate worth of financing the alternative as well as to build in adequate income to validate the risk. Presently costs to provide a floor covering or “placed” for earnings changes, are about 1% of the incomes being covered.

One such purchase, described a “ Proxy Income Swap“, was specified thoroughly in a short article in Environmental Financing reporting on a purchase whereby a 10yr commitment for fastened cash motion was switched for the drifting incomes of the wind ranches, created to hedge wind amount risks. The participants have actually been:.

.

Norton Rose specifies on the subtlety of the cost organization, in Proxy income swaps for solar: “Danger-transfer goods, appearing like amount locations or swaps, right now are typical item selections, acting as offtake prep work instead of standard power acquire contracts.” Proxy earnings swaps deal with

- ” kind risk” pertaining to earnings decreases at midday arising from decrease in worth (” duck contour” effect) due to the fact that the related result of picture electric production heights.

The Endeavor pays the hedge provider a drifting amount every quarter, which is computed due to the fact that the endeavor’s “proxy age”, increased by the center worth for the negotiation period, which in flip is established using a worked out technique that transforms irradiance right into a computed amount of electric power result. The costs is connected - to the variable parts

- of irradiance, timing & & amount, along with the changing center worth. In alternative, the Bush Vendor pays the endeavor a collection lump-sum per quarter, regardless of irradiance, amount or timing of the power generated or the market-clearing worth for electric power. As an outcome of the secured cost is not connected

- to exact result

- , the picture electric proxy earnings swap manages a foreseeable earnings stream as well as minimizes irradiance risk, worth risk as well as kind risk for the endeavor.

- It’s a financial bush, that suggests no power is acquired within the purchase, every one of the power generated is used by the Endeavor to the indigenous grid, with the Endeavor collecting the incomes. The bush is worked out quarterly, with the Bush Vendor paying the secured amount & & the Endeavor paying the “proxy earnings”, the Swap.

Difference: If the proxy earnings is less than the secured amount, the hedge provider pays the difference to the Endeavor; & & the other way around, if the proxy earnings is above the secured amount, the on the internet added earnings is paid by the Endeavor to the hedge provider. No cost is made by both aspect if they’re equivalent.

.

The New York City Inexperienced Banks manages credit report improvements

, a multi-developer gathering solution (packing of a variety of smaller sized picture electric financial investments), as well as standard fundings. CT & & NY

have actually jointly spent almost $575 billion in full clear power financing, which have actually activated individual industry financing by 3-6x the amount of public industry {bucks}.

Final Thought

Threat reduction plainly can include worth to each contractors as well as possession supervisors, there are a number of various essential aspects which will certainly eclipse these benefits: a) tax obligation insurance coverage plans impacting funding at each the endeavor financing phase as well as the possession management phase, as well as b) aspects impacting energy’s determination so as to include eco-friendly ability, which might be stood up to each in lobbying as well as on the functional phase in building out affiliations.

Threat reduction in renewables development as an inceptive location will apparently continue to widen, as well as ideally the amount of valuables held in all kinds of profile management will certainly continue to be as well as create recognized as a crucial chauffeur for rapid advancement of eco-friendly age.

Biography(*)

Daryl Roberts has actually been complying with eco-friendly power expertise & & protection for twenty years, the majority of recently worried concerning EV billing facilities, team picture electric development as well as internet metering protection, energy range picture electric development as well as endeavor funding, as well as eco-friendly power possession management. He has actually joined Sierra Subscription electric auto protection campaigns, as well as provided seeking advice from for give functions to place in metropolitan EV billing terminals. He has actually been worried about advertising and marketing approach development for service jobs in numerous used scientific researches, for ethanol, waste-to-energy gasification of metropolitan solid waste, PV manufacture on building glass, as well as LENR evaluation. In advance he had actually struggled for virtually twenty years on prosecuted clinical negligence insurance claims.

(*)