In California, which represents half of the USA residential photo voltaic market, the third iteration of internet power metering (NEM) guidelines has decreased the funds made for electrical energy fed into the grid from new residential photo voltaic arrays by 75%, drastically altering return-on-investment calculations. The “NEM 3.0” guidelines took impact on April 15, 2023, for brand spanking new photo voltaic prospects, with current photo voltaic arrays grandfathered into earlier regimes.

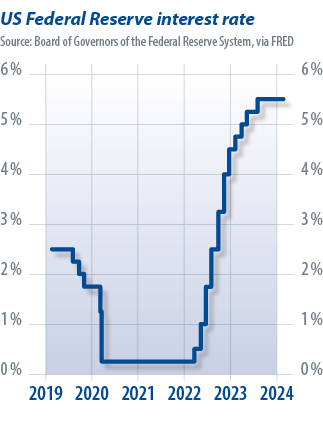

Whereas NEM 3.0 boosted the proposition for pairing batteries with photo voltaic, entry-level capital prices stay excessive. With rates of interest rising over the previous yr, because of the U.S. Federal Reserve elevating its goal vary for the federal funds charge, loans to assist buy and set up photo voltaic panels have risen from historic lows to greater than 5.5% in official charges – and to eight% and past from finance corporations.

With loans costly and incentives eliminated, Californian residential PV has been devastated. By late 2023, rooftop photo voltaic installations had fallen 80%, driving greater than 17,000 layoffs – 22% of the trade. In February 2024, publicly traded installer Sunworks filed for chapter following a 29.5% decline in quarterly revenues, yr over yr, for the third quarter of 2023, led by a 44.5% decline in residential PV. Sunrun posted a lack of greater than $1 billion in its most up-to-date quarter.

Deep Patel, founder and chief govt officer of California-based Go Inexperienced Photo voltaic, is chapter chief for the California Photo voltaic & Storage Affiliation (CALSSA) in Los Angeles. He mentioned NEM 3.0’s in a single day change hasn’t simply damage photo voltaic uptake, it has broken wider curiosity in PV, with on-line boards similar to social media platform Reddit’s photo voltaic subreddit seeing loads of complaints and questions.

“Initially, simply on Reddit, lots of people are confused [about whether solar] now is smart or not,” mentioned Patel. “There’s an entire client notion factor happening. These individuals say, ‘If I didn’t get NEM 2.0, I’m not even going to have a look at NEM 3.0 guidelines.’ Or they are saying, ‘Hey, a battery may also help me,’ however then they get sticker shock: A typical [solar] system runs you $20,000, however including a battery on high runs you $40,000.”

“The American client funds the whole lot and so they simply don’t have the capital to make massive purchases. So even when these battery programs make sense, it’d’ve been nice if rates of interest have been nonetheless at 2% however borrowing prices have risen. In order that they’re punting the choice right down to when financing charges are decrease. That’s inflicting stress with distributors and installers and so forth.”

Whereas the photo voltaic trade can considerably cheerfully dub the dizzying highs and terrifying lows of the cyclical trade as all a part of the “photo voltaic coaster,” the truth is grim in the case of establishing an easy trade the place individuals can depend on long-term warranties and help after a five-figure outlay that impacts the worth and look of their house.

Silver lining

The NEM 3.0 guidelines could ultimately profit key suppliers of residential energy electronics – and likewise module-level energy electronics (MLPE). The brand new guidelines in California incentivize each house storage and extra superior programs past incomes feed-in tariffs, together with photo voltaic self-consumption, power storage, electrical automobile charging, and extra. Reaching these options requires extra superior MLPE merchandise from makers similar to Enphase, SolarEdge, and others. The short-term downturn is especially powerful, although, given the state’s outsized contribution to the USA residential market.

Liam Coman, photo voltaic analyst at S&P International Commodity Insights, advised pv journal that the scenario is hard however not a catastrophe. “S&P International predicts MLPE shipments to be down by 4% in 2024 however to develop long-term, out to 2030,” he mentioned.

Information from the corporate present that world microinverter and energy optimizer shipments grew 19% in 2023, to a report excessive of 26 GW, as non-United States geographies held up nicely.

Whereas a drop from report highs isn’t inherently disastrous, the trade’s growth-dependent mannequin is the issue for corporations closely invested in United States residential photo voltaic. Firms depend on growing quarterly gross sales, leaving them susceptible to overstaffing and extra stock throughout downturns.

“Excessive stock ranges and a slowdown in residential demand, notably in California following the introduction of NEM 3.0, has had a twin detrimental influence on MLPE suppliers within the US because the second half of 2023,” mentioned Coman.

MLPE woes

Two of the USA’ largest photo voltaic MLPE suppliers, Enphase Vitality – primarily based in Fremont, California, and SolarEdge, headquartered in Herzliya, Israel – closely goal the residential market with superior inverter and optimizer options. Each provide installers and corporations, together with Sunrun, leaving them uncovered to the present United States residential downturn.

Though different markets present higher outcomes, SolarEdge mentioned it might reduce 900 jobs – 16% of its workforce – whereas Enphase reduce 350 roles, or 10% of its employees and mentioned it might stop operations at its contract manufacturing areas in Timisoara, Romania, and in Wisconsin, in a blow to manufacturing.

Financing woes

A problem dealing with United States residential photo voltaic is that rising rates of interest have pushed up financing prices, discouraging prospects and exposing extremely leveraged companies and fly-by-night operators. Many corporations provide photo voltaic lease preparations, enabling prospects to keep away from heavy upfront prices. Low rates of interest had made finance enticing, with leased PV accounting for about 70% of the residential photo voltaic market. EnergySage Market, a United States-based clear power comparability web site, says an 11 kW photo voltaic array got here in at a median of $22,022 in 2024. Clients might keep away from upfront prices by taking out leases of as much as 25 years, spreading the prices in month-to-month funds till they personal their programs. Leases trump the financing of such arrays with loans as a result of they usually contain the installers masking upkeep points through the lease time period. Much less scrupulous installers, nevertheless, have buried onerous monetary phrases within the small print. Leasing corporations use extra superior inverters and optimizers to observe their photo voltaic fleet. A downturn for photo voltaic leasing compounds the issues for MLPE. Sunrun and SunPower, two of the biggest photo voltaic corporations in the USA, reported sobering numbers of their most up-to-date financials. Sunrun misplaced greater than $1 billion in simply three months and noticed photo voltaic power programs and product gross sales revenues from the third quarter of 2023 fall 32% from a yr earlier. SunPower’s outcomes prompted it to warn that its enterprise might fold. It acquired a $175 million capital injection in December, albeit coupled with onerous monetary phrases.

Sophie Karp, senior analyst for electrical utilities, energy, and renewable power at KeyBanc Capital Markets, agreed with that evaluation. “We imagine that when channel stock ranges normalize, Enphase and SolarEdge ought to each develop at a charge just like the general progress charge in mature markets,” Karp mentioned. “Nonetheless, we don’t anticipate this normalization to grow to be obvious till mid-2024 on the earliest.”

Karp additionally identified that the problems being skilled by the section will not be indicative of wider issues in photo voltaic.

“I don’t imagine the problem with Enphase and SolarEdge is indicative of the efficiency of the photo voltaic trade as an entire,” she mentioned. “Each cater closely to the residential photo voltaic market, a distinct segment subset of the photo voltaic trade which skilled a “good storm” of hostile regulatory consequence and quickly rising rates of interest in a comparatively brief time frame. I imagine that within the medium- to long-run, residential photo voltaic with storage will proceed to current a lovely worth proposition for householders within the US.”

Biju Perincheril, an analyst at buying and selling agency Susquehanna, agreed, noting that points are enhancing exterior California to an extent.

“Current allow information seem to indicate non-California markets are stabilizing,” mentioned Perincheril. “That is in keeping with latest commentary from Enphase. In fact, the California restoration continues to be a wildcard.” The analyst mentioned the latter half of 2024 ought to see a restoration but it surely might not be equally weighted. “We predict the restoration for SolarEdge could possibly be barely behind Enphase and, due to this fact, [we are] modelling a bigger year-on-year income decline for SolarEdge this yr.”

Provides squeezed

SolarEdge seems to be dealing with extra constant stress than Enphase, from analysts similar to Perincheril and on the inventory market itself.

A November 2023 trade notice from Phil Shen, managing director of Roth Capital Companions, mentioned that an installer in the USA was shifting from serving 50% Enphase inverters and 50% SolarEdge inverters, to an 80% Enphase, 10% SolarEdge, 10% Tesla cut up. The quoted purpose: “After we requested about why the transfer away from SEDG [SolarEdge], he shared that the upper failure charges have been a problem.”

A November 2023 trade notice from Phil Shen, managing director of Roth Capital Companions, mentioned that an installer in the USA was shifting from serving 50% Enphase inverters and 50% SolarEdge inverters, to an 80% Enphase, 10% SolarEdge, 10% Tesla cut up. The quoted purpose: “After we requested about why the transfer away from SEDG [SolarEdge], he shared that the upper failure charges have been a problem.”

These reliability considerations proceed to pop up in reviews and on-line. On boards together with Reddit, Go Inexperienced Photo voltaic’s Patel is certainly one of many lively contributors, with the corporate founder freely offering recommendation for individuals and answering questions on subjects similar to “Want recommendation on batteries?” or “Greatest worth inverter?” in addition to about panel and inverter makers, together with SolarEdge.

Patel, when requested about his expertise with the Israeli firm, mentioned his enterprise, which has been lively within the trade since 2006, had progressively transitioned away from SolarEdge, beginning round 4 to 5 years in the past.

“We used to promote loads of SolarEdge … however SolarEdge for us began slipping when it comes to buyer help, high quality, and turnaround occasions,” mentioned Patel. “Lead occasions received very lengthy at one level through the pandemic. The draw back with SolarEdge is that when the inverter doesn’t work, the entire system is down, in order that wasn’t good for purchasers and we haven’t actually been again to SolarEdge once more.

“The worth proposition SolarEdge affords [via attractive pricing] isn’t there for us. You additionally produce other inverter guys nipping on the heels – you might have Sol-Ark now, and GoodWe now has a residential string inverter with 4 MPPT [maximum power point tracking] trackers within the US, which is nice. Even Tesla is approaching sturdy, not simply going direct to prospects however letting installers promote it for them.”

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.