Biogas doesn’t just offer a backup plan for tech companies seeking more power; it provides a blueprint for sustainability. By transforming landfill, agricultural, and wastewater emissions into usable power, biogas solves two problems at once: it reduces fugitive methane emissions, a potent greenhouse gas (GHG), and generates renewable electricity. This is energy that’s good for business and better for the planet.

As artificial intelligence (AI) and cloud computing expand rapidly, so does the electricity demand of data centers. These digital nerve centers consumed about 4.4% of total U.S. electricity in 2023, and could use up to 12% of total U.S. electricity by 2028, according to a U.S. Department of Energy (DOE) data center energy use report published in December 2024. In tech-heavy states like Virginia, data centers account for more than 25% of total power consumption, according to an EPRI white paper. With projections indicating an additional 325 to 580 terawatt-hours (TWh) of demand by 2028, the industry urgently needs scalable, low-carbon solutions.

Produced through the anaerobic digestion of organic waste, biogas can be converted into electricity at or near the point of generation, such as at landfills, farms, or wastewater treatment plants. These distributed generation assets offer a reliable, renewable alternative to fossil-based grid electricity and can be deployed at a relatively higher speed to market than traditional generation facilities.

There is a renewed opportunity to pair waste management with power demand. Data centers, if they want always-on, renewable electricity, can source it from biogas projects that also help communities manage waste more sustainably.

From Waste to Watts

Biogas typically contains 45% to 70% methane, with the remainder composed mostly of carbon dioxide (CO2) and trace amounts of other gases like hydrogen sulfide, nitrogen, and water vapor. When burned in a generator, biogas can produce baseload electricity with capacity factors comparable to fossil-based natural gas, but without the climate penalty. Biogas projects deliver dual environmental benefits: avoiding methane emissions from waste and displacing fossil energy. Methane is 25 to 80 times more potent as a GHG gas than CO2 over a 20-year horizon.

The U.S. hosts approximately 2,500 operational biogas systems, with the potential to add another roughly 17,000 sites, which is enough to generate about 194 million megawatt-hours (MWh) annually and displace the CO2 equivalent of removing 2.6 million cars. Despite this promise, progress is slowed by limited long-term power purchase agreements (PPAs) and waning renewable credits.

Biogas vs. Other Energy Sources

When comparing clean energy options for data centers, the choice isn’t just about which fuel has the lowest emissions—it’s about balancing emissions, cost, scalability, reliability, and speed to market. Biogas stands out as a carbon-smart, cost-effective, and rapidly deployable solution that can reduce reliance on centralized fossil fuel infrastructure, while also supporting rural economies by creating jobs and revenue streams for farmers, landowners, and municipal wastewater treatment facilities.

Biogas engines operate 24/7, making them a vital asset that is essential for maintaining data center uptime. Additionally, co-located biogas projects can serve as microgrids capable of islanding during grid-wide events. Low-impact interconnections mean less dependence on new transmission, a persistent bottleneck in many regional grids.

Biogas is available now, and projects can be completed in as little as six to 18 months, often utilizing existing infrastructure such as landfill methane capture systems or wastewater treatment plants. Feedstocks for biogas—like municipal food and organic waste, agricultural residues, animal manure, sewage sludge, and green waste—are plentiful and widely available in both urban and rural areas. With carbon emissions of about 50 grams of CO2e/kWh, biogas can even reach carbon-negative levels when methane capture benefits are fully considered.

Additionally, the waste-to-energy pathway offers several benefits. It decreases methane emissions from decomposing organic waste, replaces fossil fuels, provides consistent base or peak power, helps reduce landfill volumes, supports local employment, and allows wastewater facilities to recover energy, heat, and revenue from sludge treatment.

Cost is another differentiator. At about $0.07 per kWh, biogas is competitive with other sources and is dispatchable around-the-clock power, which is critical for data centers that demand uninterrupted uptime.

Table 1 compares key attributes of major power sources used in or proposed for data center applications. Biogas may not top the list in every category, but its combination of low emissions, reasonable cost, and fast deployment makes it a compelling transitional—and in many cases, long-term—solution for clean, resilient data infrastructure.

Regional Impacts

One example is the Pennsylvania-New Jersey-Maryland Interconnection (PJM), a regional transmission organization (RTO) that serves 65 million customers from Illinois to the mid-Atlantic. The PJM obtains about 48% of its power generation capacity from natural gas, with coal and nuclear each accounting for 21%. The capacity auction for 2025–2026 reached approximately $14.7 billion, an eightfold increase driven largely by data center demand spikes and generator retirements. This led to capacity clearing prices topping $269.92/MW-day, compared to just $28.92/MW-day the year prior.

AI-heavy data centers are stressing grid operations. The U.S. Energy Information Administration (EIA) projects power demand will rise to 4,193 billion kilowatt hours (kWh) in 2025 and 4,283 billion kWh in 2026 from a record 4,097 billion kWh in 2024. Grid operators warn that without fast new capacity, reliability and rates will suffer. Biogas deployment now could alleviate future shortfalls, especially in zones like Virginia and New Jersey, where interconnection barriers have slowed renewable uptake.

Not Just Local: Aggregating Biogas Distribution

Data centers don’t necessarily need to sit next to a digester to benefit from biogas electricity. Through virtual power purchase agreements (VPPAs) and grid-connected systems, electricity from multiple biogas sites, such as landfills or dairies, can be aggregated and matched to a facility’s energy use, regardless of location.

This approach, already common in wind and solar markets, is gaining traction for firm renewables like biogas. In a typical VPPA, a developer or energy aggregator bundles output and environmental attributes (like renewable energy credits, or RECs) from several smaller biogas projects. Corporate buyers, including data centers, then contract for this power virtually, receiving the emissions benefits without requiring direct physical delivery.

Utilities often play a supporting role by managing interconnection, dispatch, and, in some cases, offering green tariff programs, utility-led clean power options for large customers. While aggregating biogas involves more complexity than wind or solar due to smaller project size and feedstock variability, new tools like digital REC tracking and lifecycle-based credit systems are making it increasingly viable. Ultimately, aggregation helps scale biogas from a local waste solution into a grid-integrated, low-carbon energy source capable of serving the demands of the digital economy.

Biogas Across the U.S.

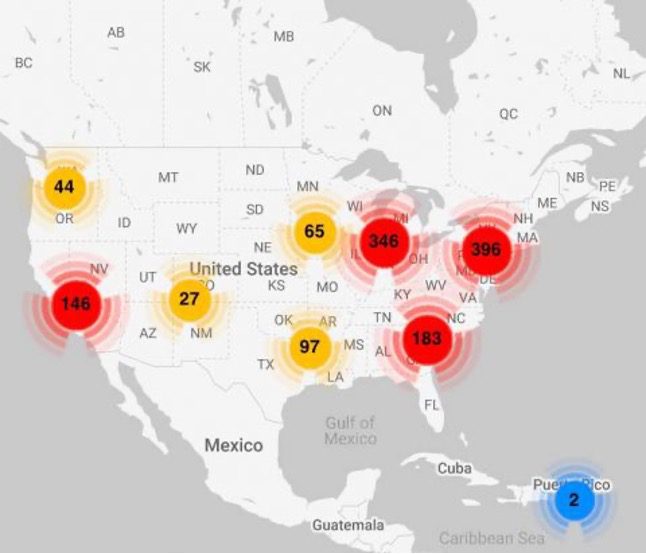

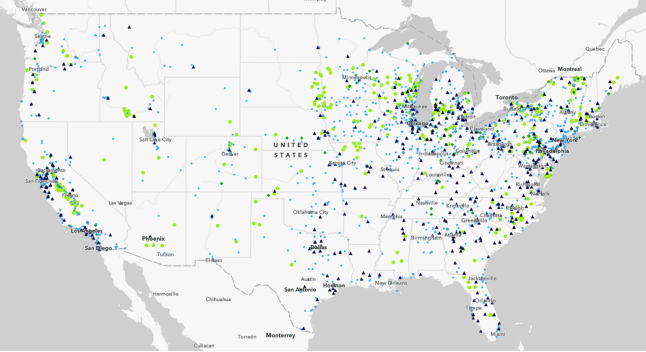

To better understand the national scale and potential of biogas electricity, it’s helpful to visualize where current biogas projects operate and where new ones could be developed. The American Biogas Council offers two compelling charts that map the distributed power potential of organic waste. The first is a market snapshot map (Figure 1), illustrating both existing and untapped sites across all 50 states, highlighting opportunities in places like Pennsylvania, California, and the Midwest. The second map (Figure 2) shows more than 2,300 active biogas projects, including landfills, farms, and wastewater treatment plants. Together, these visuals reinforce that biogas is not just a niche solution, but a scalable, distributed, and ready-to-deploy asset in the clean energy transition.

Policy and Market Challenges

Despite its promise, biogas-to-power remains disadvantaged by a lack of policy and market parity with other renewables. Technologies like solar and wind benefit from longstanding tax credits, favorable project financing, and inclusion in most renewable portfolio standards (RPS). Biogas, by contrast, is often excluded from those frameworks or limited in scale and credit eligibility.

At the federal level, this landscape is changing. The Inflation Reduction Act (IRA) extended the Investment Tax Credit (ITC) and Production Tax Credit (PTC) to include biogas systems under Section 48E. According to the DOE, these credits now offer up to a 30% baseline incentive, with stackable bonuses for domestic content, prevailing wages, or location in energy communities. Additionally, the Section 45Z Clean Fuel Production Credit, which went into effect this year, provides performance-based incentives for clean fuels like renewable natural gas (RNG), including electricity generated from agricultural waste such as dairy manure.

The recently enacted One Big Beautiful Bill Act (OBBBA) maintains many of these key incentives and reinforces federal support for the biogas sector. Industry stakeholders have noted that the bill helps provide much-needed stability and planning certainty for developers by continuing support for clean fuel production and biogas-to-power projects.

Together, the provisions in the IRA and OBBBA represent the most comprehensive federal support to date for biogas development. This policy foundation enables continued growth of projects that turn waste into low-carbon energy while supporting rural economies and climate goals.

Additionally, several state-level programs also recognize the unique environmental value of biogas, though eligibility varies widely. In California, its Low Carbon Fuel Standard (LCFS) offers performance-based credits for biogas used as a transportation fuel or to displace fossil energy, and the state’s Energy Commission provides grants for biogas infrastructure, and research and development (R&D). Illinois offers property tax exemptions and energy consumption tax incentives through the state’s Clean Energy Jobs Act. New Mexico and Oregon include landfill gas and manure digesters in their net metering and public purpose funding programs, respectively. And in Pennsylvania, biogas qualifies under the state’s Alternative Energy Portfolio Standard (AEPS) as a Tier I renewable, encouraging utilities to purchase power from qualified biogas facilities.

However, many regions still lack the robust policy frameworks needed to incentivize smaller or distributed biogas projects, particularly those focused on electricity rather than pipeline-injected RNG. Standardized crediting systems, like the LCFS model in California or lifecycle-based performance metrics, could help address this gap by rewarding both the climate impact (methane abatement) and resilience value (dispatchable baseload power) of biogas systems. Expanding these frameworks to explicitly support electricity use by high-demand sectors, such as data centers, could further accelerate adoption by aligning incentives with the growing need for resilient, low-carbon baseload power.

Looking Ahead

Biogas may not be the largest renewable source, but it’s uniquely positioned to meet near-term baseload demand with low-carbon, reliable, and dispatchable power. In the regions managed by grid operators, with capacity constraints tight and emissions targets firm, biogas-to-electricity offers one of the fastest, lowest-risk paths to decarbonization for data center infrastructure. By linking societal waste with server workloads, this model not only cleans the planet, but it also powers its future. Furthermore, biogas aligns with the current administration’s goals for energy dominance by reducing dependence on imported fuels, lowering emissions, and offering a reliable energy source at a cost-effective price. It turns waste into a strategic asset, supporting domestic energy security, environmental resilience, and infrastructure stability—a true win-win-win.

—Dave Lindenmuth ([email protected]) is senior director of Growth and Development with EcoEngineers, an LRQA company.