Relying on the place you might be within the nation, integrating vitality storage techniques (ESS) with business photo voltaic photovoltaic (PV) techniques provides important monetary advantages. ESS can improve the cost-effectiveness of photo voltaic vitality via methods like vitality arbitrage, peak demand discount, and avoiding PV export penalties. These benefits result in substantial financial savings and enhance the general return on funding for business photo voltaic installations. On this article, we discover the highest three explanation why ESS makes business PV techniques less expensive.

1. Arbitrage and Time-of-Use (TOU) Offset

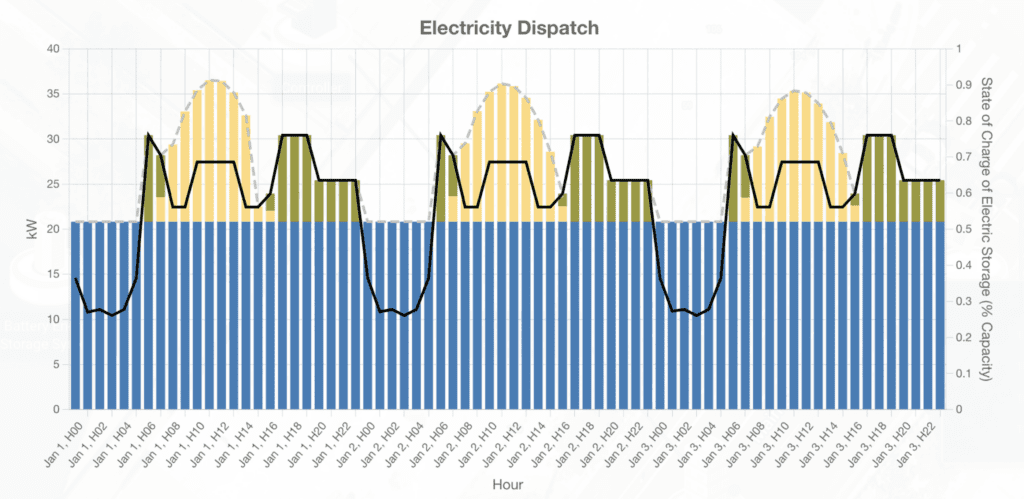

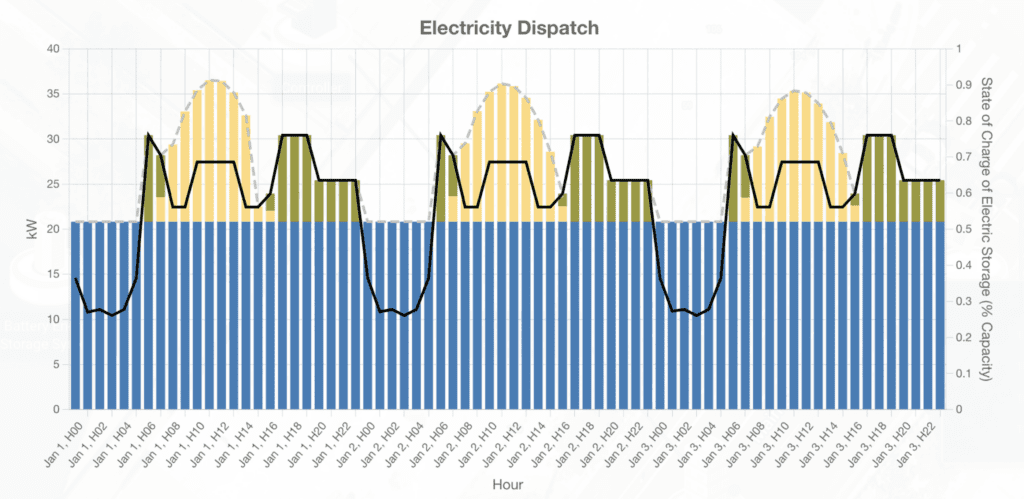

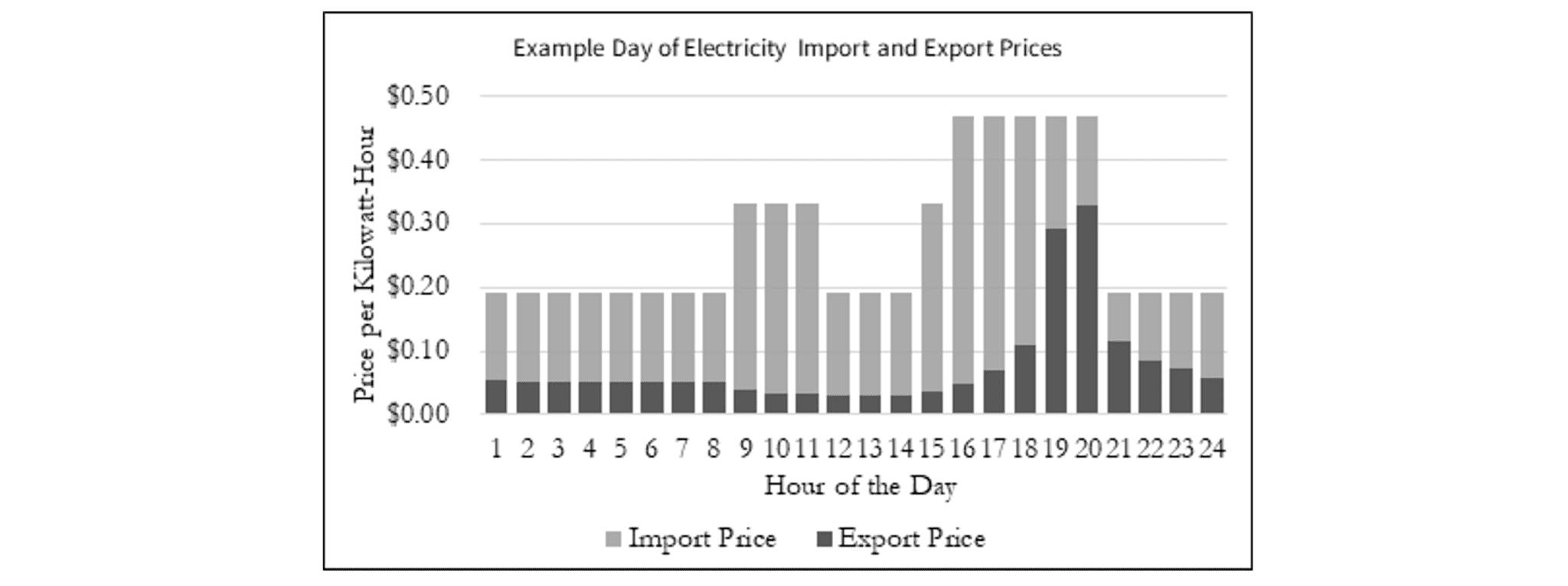

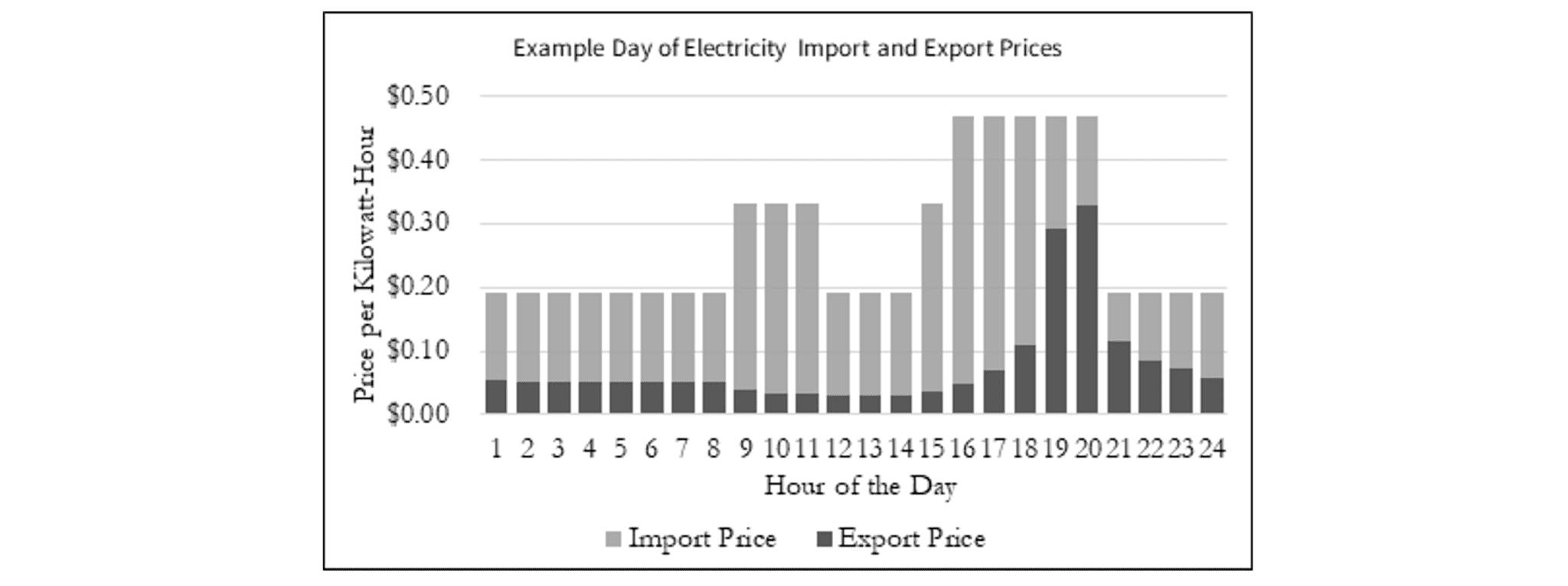

Arbitrage is a key monetary technique that leverages the timing of vitality utilization to maximise price financial savings. Companies with vitality storage can retailer extra vitality produced by PV arrays onsite when provide outpaces demand or cost the vitality storage with grid electrical energy when charges are low. This saved vitality can then be dispatched throughout instances of excessive demand or excessive TOU charges (which generally happen within the night or throughout peak enterprise hours) to keep away from the steep prices related to these peak intervals.

In an interview for this text, Yotta Vitality’s Mitch Sargent gave the next use instances for business arbitrage: “Think about a bakery that begins its day earlier than the solar comes up. The enterprise proprietor might program the battery to dispatch within the early morning because the kitchen ramps up. Or maybe the top consumer is a big industrial facility with a number of shifts. In that case, you may dimension an ESS for arbitrage to offset the nighttime utilization and energy the daytime shifts principally with PV.”

In California, the night TOU charges could be 10-30% larger than off-peak charges (10:00 am to 2:00 pm), making arbitrage’s monetary advantages substantial. Companies can drastically scale back their electrical energy payments utilizing saved vitality throughout these costly intervals. This technique is especially efficient for companies with fluctuating vitality wants, equivalent to manufacturing vegetation, hospitals, healthcare services, business places of work, retail shops, and warehouses or distribution facilities. For instance, a producing plant might program its ESS to discharge when grid electrical energy charges are highest and to cost from onsite photo voltaic or the grid when charges are extra reasonably priced.

By means of arbitrage, Californians may also mitigate the impression of recent web vitality metering (NEM) insurance policies, equivalent to NEM 3.0, which provides decrease credit for extra vitality exported to the grid. By storing and utilizing this vitality on-site, companies can keep away from the decreased monetary returns from exporting solar energy. This maximizes the usage of generated photo voltaic vitality and will increase the general return on funding for the PV system.

2. Peak Demand Discount

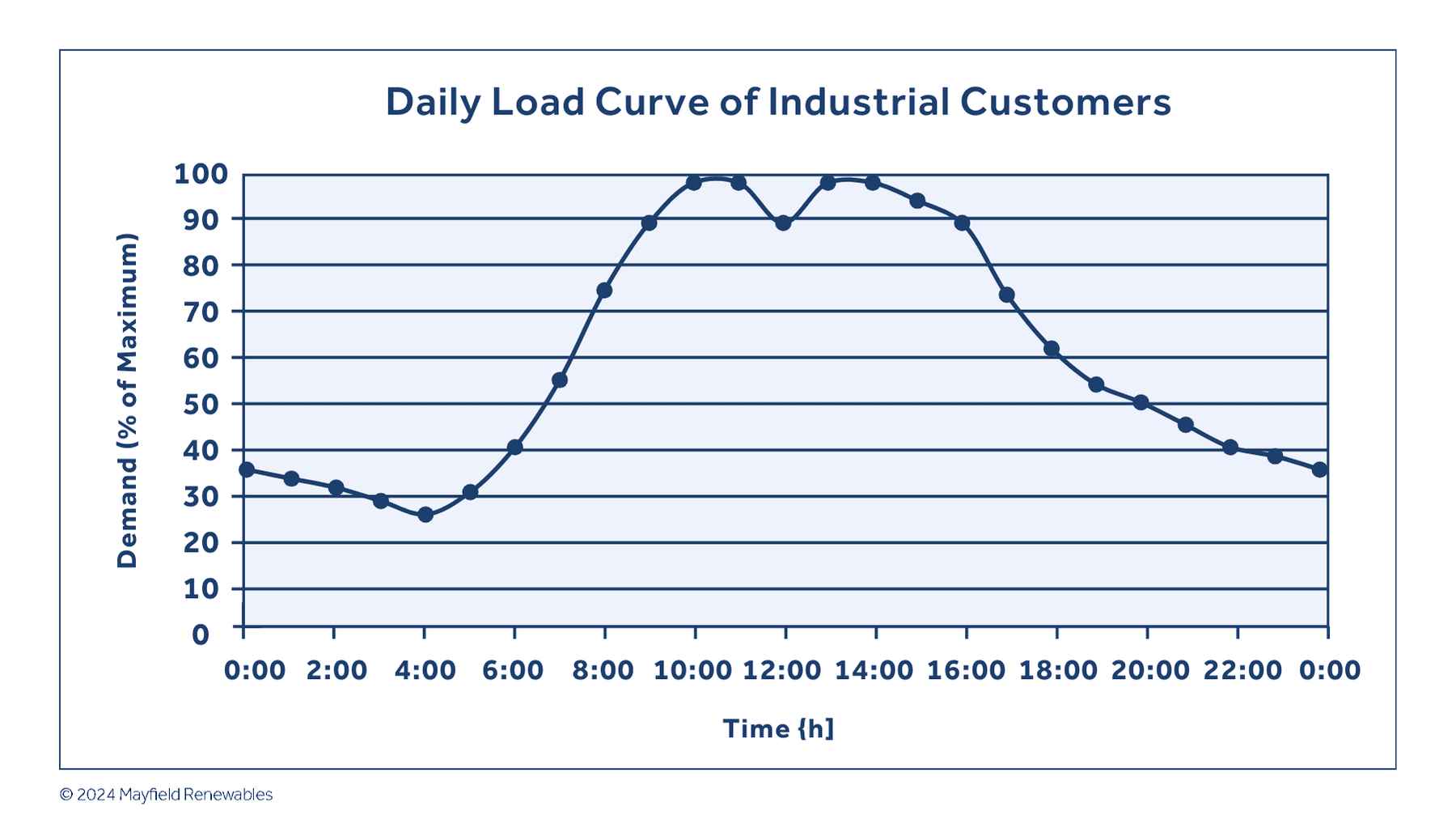

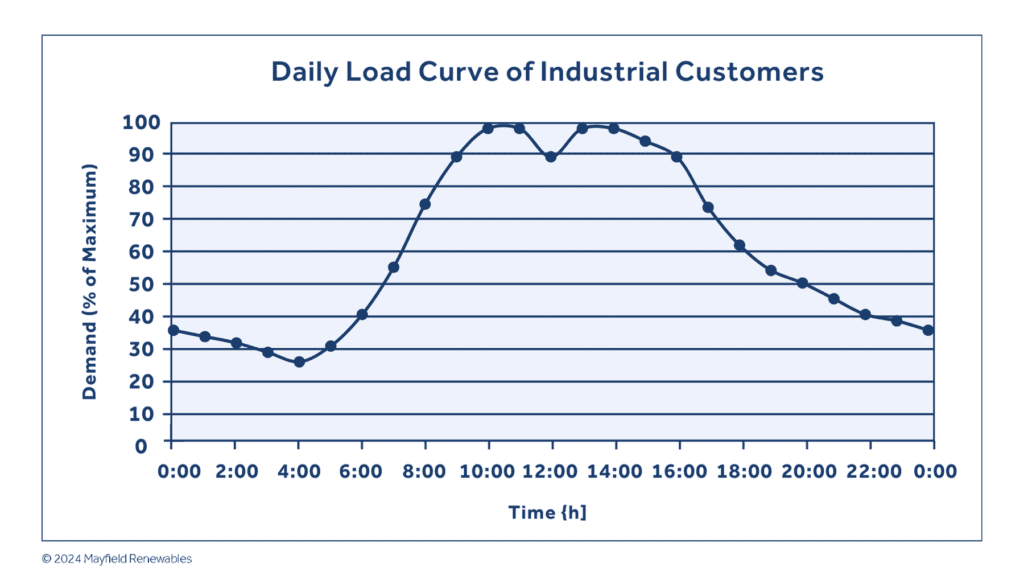

Peak demand expenses are a major factor of economic electrical energy payments, usually leading to substantial prices for companies with intermittent excessive energy utilization. These expenses are based mostly on the very best 15-minute interval energy demand inside a billing cycle. Peak demand charges incentivize enterprise homeowners to have constant demand all through the workday, which is difficult, if not not possible, with out vitality storage.

A correctly sized and programmed ESS permits enterprise homeowners to strategically discharge their batteries when their facility demand is approaching peak ranges, successfully flattening the demand curve. For services with tools that pulls important energy intermittently—equivalent to medical services with MRI machines that cycle on and off all through the day—peak shaving can present dramatic price reductions. By smoothing out demand peaks, the ESS ensures the ability doesn’t incur excessive demand expenses, resulting in a faster payback than PV-only techniques.

Furthermore, decreasing peak demand can qualify companies for extra favorable utility price plans, additional enhancing price financial savings. As an example, by decreasing peak demand to a sure threshold, companies might be able to swap to a lower-cost tariff. That is significantly helpful in areas with tiered price buildings, the place small reductions in peak demand can lead to substantial financial savings.

Peak demand discount via vitality storage cuts prices and enhances a enterprise’s total vitality administration technique. It gives higher predictability and management over vitality bills, serving to companies handle their budgets and operational prices higher. This strategic benefit is essential for companies with various operational calls for and helps them optimize their vitality utilization patterns to attain most effectivity and cost-effectiveness.

3. Avoidance of PV Export Penalties and Elevated ROI

With latest adjustments in web metering insurance policies, significantly in areas like California, such because the introduction of NEM 3.0, the monetary advantages of exporting extra PV era to the grid have considerably diminished. Below these new guidelines, the compensation for exported photo voltaic vitality has been decreased, making it much less financially enticing for companies to depend on conventional web metering alone. This shift necessitates a strategic strategy to maximise the worth of generated photo voltaic vitality, and integrating ESS gives an efficient resolution.

Vitality storage techniques enable companies to retailer surplus photo voltaic vitality that may in any other case be exported to the grid at a decrease price or with out compensation below the brand new NEM 3.0 guidelines. By storing this extra vitality, companies can use it in periods when their photo voltaic arrays usually are not producing electrical energy, equivalent to throughout the night or on cloudy days. This self-consumption strategy ensures that the electrical energy produced by the PV system is used extra effectively, avoiding the monetary penalties related to decreased export credit.

Moreover, ESS allows companies to time-shift their vitality utilization, using saved photo voltaic vitality throughout peak price intervals when electrical energy costs are highest. By aligning vitality utilization with intervals of highest want and price, companies can scale back reliance on the grid and obtain the next return on funding (ROI) from their PV techniques.

Exact sizing of the ESS performs an important position in optimizing its cost-effectiveness. Customizing the ESS to the particular vitality wants and cargo profiles of the enterprise ensures that the system is neither undersized nor outsized. This tailor-made strategy minimizes capital expenditure (CapEx) whereas maximizing lifetime financial savings and ROI. Sizing vitality storage techniques via iterative feasibility research is likely one of the many companies our engineering staff gives.

4. Bonus – Assembly Sustainability Targets

Lastly, the power to retailer and use photo voltaic vitality on-site enhances the general sustainability profile of the enterprise. By decreasing reliance on grid electrical energy and minimizing wasted vitality, companies contribute to environmental sustainability targets and obtain financial advantages. This twin benefit strengthens the case for integrating ESS with business PV techniques, making it a prudent funding for forward-thinking companies. It will probably additionally act as a strong advertising and marketing software — companies with (solar-plus-) vitality storage can tout their low carbon footprint.

Conclusion

Integrating ESS with business PV techniques provides important monetary benefits, making it a essential element for companies aiming to optimize their vitality prices. ESS maximizes the financial advantages of photo voltaic vitality installations via efficient vitality arbitrage, substantial discount in peak demand expenses, and avoiding penalties related to PV exports. This integration enhances the return on funding and ensures companies adapt to evolving utility price buildings and market circumstances. As developments in battery know-how proceed to drive down prices and enhance effectivity, the adoption of ESS in business PV techniques is about to turn into much more compelling, offering a sustainable and cost-effective vitality resolution for the longer term.

Are you in search of an engineering companion who can navigate consulting on product choice and worth engineering alternatives? Attain out to debate how we will help your staff as we speak.