Spain’s Iberdrola introduced on August 2 that it had agreed to accumulate 88% of the UK’s Electrical energy North West (ENW) for an fairness worth of €2.5b (£2.1b).

The deal places ENW’s whole worth, together with debt, at roughly €5b (£4.2b).

Iberdrola famous that the deal was in keeping with its technique of investing in electrical energy networks in international locations with a powerful credit standing – within the UK’s case it’s AA.

The corporate already owns ScottishPower, which it says is the one 100% inexperienced built-in utility within the UK.

Because it accomplished its acquisition of ScottishPower in 2007, Iberdrola has invested round €36b (£30b) within the nation.

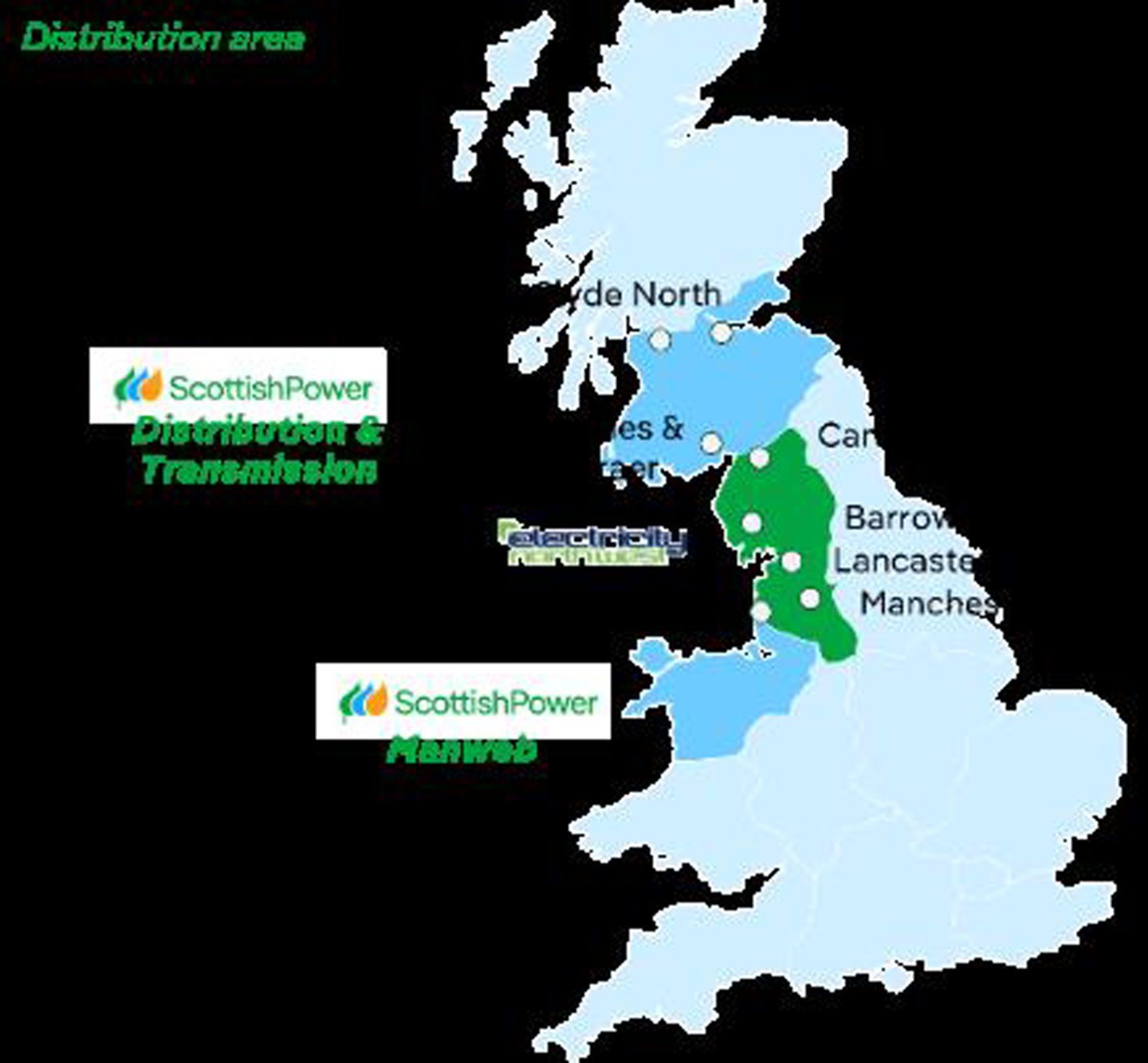

ENW distributes electrical energy to virtually 5m folks within the Northwest of England and owns roughly 60,000 km of electrical energy distribution networks. The acquisition is predicted to assist Iberdrola join areas it already serves, as geographically, ENW is situated between the 2 present ScottishPower networks licence areas, in central and southern Scotland and Merseyside and North Wales.

As soon as the acquisition of ENW can be full, the UK will turn out to be Iberdrola’s main market by regulated asset base, with a price of roughly €14b (£11.9b), overtaking the US market, valued at round €13.3b (£11.1b).

Iberdrola will even turn out to be the second largest electrical energy community operator within the UK, distributing electrical energy to roughly 12m folks within the nation, throughout a community spanning greater than 170,000 km.

The corporate subsequently additionally sees the deal as aligning with its objective to develop its electrical energy networks enterprise.

“This transaction reinforces our dedication to investing considerably in electrical energy networks, that are a important part for supporting the electrification and decarbonisation of the economic system,” acknowledged Iberdrola’s govt chairman, Ignacio Galan.

“The settlement can be in line with our technique to spend money on international locations which have bold funding plans and secure and predictable laws. Because of this acquisition, our regulated networks asset base within the UK is now valued at €14b. When mixed with the US, these two markets now symbolize two-thirds of our whole world regulated asset base.”

New possession

Iberdrola mentioned in its acquisition announcement {that a} consortium of buyers from Japan, led by Kansai, would retain 12% of ENW’s capital, having signed a shareholders’ settlement with the Spanish firm to collaborate on a long-term foundation.

This refers to Osaka-based Kansai Electrical Energy Co., also called KEPCO or Kanden, which purchased into ENW in 2019, marking its first funding into European electrical energy distribution networks.

When Kansai acquired its ENW stake, it additionally established an funding firm within the UK, along with Daiwa Vitality & Infrastructure Co. and MHC Infrastructure UK, often called KDM Energy.

In keeping with ENW’s newest annual report, printed in July 2024, KDM Energy owned a 40% curiosity in North West Electrical energy Networks (Jersey), or NWEN (Jersey), its final guardian firm, as of March 31, 2024.

Items of infrastructure investor Equitix additionally owned 40% in NWEN (Jersey), with Swingford Holdings proudly owning 20.0%.

Iberdrola didn’t elaborate on the breakdown in possession of the stake altering palms on account of the transaction.