From pv journal 02/24

Whereas sure photo voltaic manufacturing steps are measured in nanometers, atomic layers, and fractions of a proportion or cent, ingot and wafer manufacturing extra carefully resembles heavy trade. Gleaming crystalline silicon ingots emerge from towering pullers to be sliced by diamond wire saws into iridescent, black sq., or rectangular, monocrystalline wafers.

The ingot and wafering manufacturing steps are energy hungry and produce waste within the type of kerf slurry – the residue ingot materials from between the sliced wafers. These are the PV manufacturing steps most extremely concentrated in China.

Jessica Jin is the principal analysis analyst for photo voltaic and clear power expertise at S&P International Commodity Insights Shanghai. Jin reported that in 2023, China accounted for 96% of world ingot and wafer manufacturing. She added that the wholesale change inside PV manufacturing from multicrystalline to monocrystalline expertise, in and round 2018, was decisive for China’s dominance of the manufacturing step. That dominance has prolonged upstream.

“This was led by Longi, as everybody is aware of,” she mentioned. “Since then, Chinese language tools producers working with Longi hold enhancing their expertise and in addition add capability and so they all develop up with the market growth in China.”

The event is one that’s frequent all through China’s photo voltaic success story. By aggressive scaling and shut cooperation with expertise and materials suppliers, Chinese language producers have been capable of quickly adapt new expertise and manufacturing processes, outcompeting European and American rivals first on value, after which on efficiency and effectivity.

“These days, we see most of those tools suppliers are additionally in China as nicely,” mentioned Jin. The end result being that in 2024 there are few credible pathways for non-Chinese language producers considering creating ingot and wafer capability.

European setbacks

PV manufacturing advisory Exawatt, now part of CRU Group, finds that the one notable ingot and wafer manufacturing hub exterior of China is in South East Asia. Exawatt tallied some 35 GW of wafer amenities in operation in South East Asia by the tip of 2023, with that probably increasing to 45 GW by the tip of 2024.

Whereas expansions are underneath means in South East Asia, the alternative is the case in Europe. The 12 months 2023 noticed each Norsun and Norwegian Crystal droop or wind up their operations in Europe – successfully decreasing wafer manufacturing in Europe to zero. These choices had been adopted shortly after by that of, presumably, a key provider. Polysilicon producer REC Photo voltaic Norway started winding up its operations in Kristiansand, Norway – which had an annual output of 8,000 tons – and in Heroya, Norway – with 5,500 tons – in November 2023.

Norwegian Crystal had closed its 500 MW ingot facility in Glomfjord, Norway, a month earlier. As lately as 2022, it had been pursuing plans to develop a 6 GW ingot and wafer facility however had been unable to safe funding, forcing it to start liquidation of the corporate.

In September, compatriot Norsun introduced layoffs and a manufacturing halt at its 1 GW facility in Årdal, Norway. Tellingly, Norsun is now making an attempt to determine a 5 GW ingot and wafer manufacturing facility in america. In August 2023, it introduced it had raised NOK90 million ($8.5 million) in capital in pursuit of the plan, alongside the €53.6 million ($58 million) it was awarded by the European Union Innovation Fund.

States potential

Subsidies can be found for photo voltaic producers in Europe however they pale as compared to what’s on provide in america. Within the first 12 months after the US Inflation Discount Act (IRA) was signed into regulation, bulletins had been made totaling 155 GW of annual photo voltaic manufacturing capability, proper throughout the worth chain, in accordance with commerce physique the Photo voltaic Power Industries Affiliation. Nevertheless, few had been for ingot and wafer manufacturing.

“In keeping with our mannequin, the inducement is definitely excellent for manufacturing in america,” mentioned S&P International’s Jin. “Nevertheless it’s not merely in regards to the manufacturing value but in addition different prices, just like the recycling, development value, and so forth.”

Jin mentioned that securing environmental approvals for wafer operations could show tough exterior of China. Though she did notice that previously 5 years, lots of the waste and recycling points from wafer manufacturing have been addressed.

South Korean module maker Qcells stands out as an exception. In January 2024, Qcells introduced a $2.5 billion funding choice which included 3.3 GW of annual ingot, wafer, and cell manufacturing capability, to be executed in levels. The manufacturing will contain the institution of a brand new manufacturing base, in Cartersville, Georgia – exterior of the town of Atlanta in america. It follows the growth of Qcells’ module meeting operations, to five.1 GW capability, in Dalton, Georgia, in america, accomplished in October 2023.

Provide deal

In January 2024, Qcells introduced it had expanded an current 2.5 GW module provide and engineering, procurement, and development companies cope with Microsoft to 12 GW of provide over eight years. The businesses say the tasks lined by the deal shall be provided by Qcells’ “totally built-in photo voltaic provide chain manufacturing facility in Cartersville,” to the tune of 1.5 GW per 12 months by way of 2032.

The deal gives offtake certainty to Qcells, with one-third of its ingot and wafer output accounted for in cooperation with a bankable counterparty. For its half, by working with Qcells on this means, Microsoft hopes to speed up its renewable power deployment by locking in provide and driving large-scale home manufacturing of photo voltaic modules within the course of.

“There’s at all times one thing that makes provide to the US unsure,” mentioned Alex Barrows, head of PV at Exawatt. “I can see an attraction to locking in one thing that offers you some certainty – even in the event you’re paying a premium.” PV module costs are increased in america and there stays a fancy internet of tariffs, exemptions, border seizures, moratoria, and authorized challenges, all of which might delay ultimate mission realization or blow out prices.

European producers situation ‘plea’

On Jan. 27, 2024, the European Photo voltaic Manufacturing Council (ESMC) issued a “plea for survival” to European policymakers. It argued that overseas PV module producers had been dumping modules, or promoting beneath value. It additionally pointed to the selections to stop European operations taken by Norsun, REC Photo voltaic Norway, and Norwegian Crystals – together with the winding up of the German module manufacturing traces of Swiss firm Meyer Burger. “The closure of PV module producers can be closing prospects to develop different components of the PV worth chain and European materials and element producers are thus additionally at very excessive danger,” the ESMC mentioned in an announcement. “Dropping practically all European PV module producers proper now would have irreversible adverse penalties for your entire EU PV manufacturing trade,” mentioned the ESMC’s Žygimantas Vaičiūnas. He mentioned that emergency measures have to be launched by the center of February 2024, “on the newest.”

Barrows famous that Qcells’ dad or mum firm, Hanwha, is South Korean relatively than Chinese language. It has entry to American polysilicon from REC Silicon and is on the way in which to turning into a vertically built-in United States producer – making it nicely positioned to supply stability within the face of potential coverage turmoil or geopolitical shocks. “I really feel like it’s a fairly good solution to lock in some safety,” mentioned Barrows.

But regardless of the IRA, increased costs, and benefits for regionally produced merchandise, Barrows stays skeptical of the prospects of many introduced ingot and wafer amenities in america. Alongside Qcells and Norsun; Convalt Power, CubicPV, and India’s Vikram Photo voltaic have introduced American manufacturing plans that stretch up the provision chain to ingots and wafers.

“I believe we’ll get a bit [of ingot and wafer capacity] within the US however nowhere close to what has been introduced,” mentioned Barrows. “Thirty-five GW of capability by the tip of 2026 has been introduced however I might truly suspect it’s extra seemingly that 15 GW to twenty GW shall be put in.”

Kerfless promise

On the record of aspiring producers, CubicPV stands out. Not solely has it introduced its intention to develop 10 GW of conventional ingot and wafer expertise, it’s also a proponent of “direct wafer” utilization. The corporate’s chief government officer (CEO), Frank van Mierlo, previously led 1366 Applied sciences. That enterprise had tried to commercialize “direct wafer” expertise by producing multicrystalline photo voltaic wafers from a liquid, relatively than cleft from a monocrystalline ingot.

Qcells labored in partnership with 1366 Applied sciences and achieved notable conversion effectivity achievements with the latter’s expertise, together with cells with greater than 20% effectivity. Nevertheless, when the PV trade switched to monocrystalline expertise, 1366’s wafers had been left stranded on the mistaken facet of improvement.

Germany’s NexWafe is pursuing a wafer expertise not dissimilar to that utilized by 1366. The NexWafe strategy is described as epitaxial and includes gases being deposited onto a seed substrate from which it may be separated and common right into a cell. Each approaches might be described as “kerfless” wafer manufacturing as they eliminate wafer reducing and the waste kerf it produces.

In October 2023, NexWafe broke floor at a 250 MW manufacturing facility in Germany the place it’ll make investments at the very least €70 million. Apparently, NexWafe CEO Davor Sutija was the previous president and CEO of SiNor, which ultimately grew to become Norwegian Crystals.

Manufacturing alternate options to the mature Czochralski course of for monocrystalline ingot pulling and diamond wire sawing should overcome capital expenditure, throughput, and effectivity challenges to grow to be commercially viable. Excessive cell efficiencies on epitaxial or direct wafer expertise haven’t but been reached, nor has aggressive throughput from a manufacturing facility at scale.

Manufacturing alternate options to the mature Czochralski course of for monocrystalline ingot pulling and diamond wire sawing should overcome capital expenditure, throughput, and effectivity challenges to grow to be commercially viable. Excessive cell efficiencies on epitaxial or direct wafer expertise haven’t but been reached, nor has aggressive throughput from a manufacturing facility at scale.

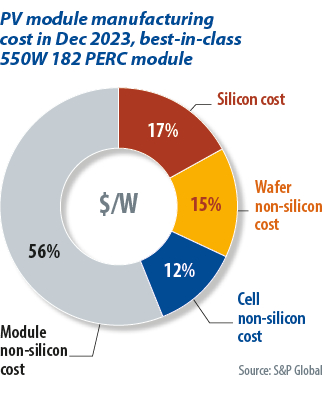

The institution of any new ingot and wafer capability with any expertise will even happen underneath intense value competitors. The 12 months 2023 noticed module costs decline by greater than 30% on international markets and there’s a glut of product in the marketplace. “We’re positively anticipating a wash within the trade subsequent 12 months,” mentioned S&P International’s Jin.

But, in instances of bankruptcies and consolidation, there are alternatives for “step change” or next-generation applied sciences. European or United States corporations could prosper whereas oversupply grips their Chinese language rivals. NexWafe and CubicPV are pursuing new approaches to wafer manufacturing regardless of manufacturing-segment adversity.

In November 2023, NexWafe appointed Rick Schwerdtfeger as chief expertise officer and André Seemaier as chief monetary officer as the corporate strikes into the commercialization part of its gas-to-wafer expertise.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.