By Vaibhav Singh, Supervisor, Power, PwC

SolarPower Europe’s Global Market Overview 2022 approximated an international mounted solar ability of 940 GW, on the back of the document ability enhancement of 168 GW in 2014. Solar power is approximated to proceed this record-breaking touch with a capability enhancement upwards of 200 GW this year, to the factor that we are counting solar power in terawatts currently. It might have taken us years to get to right here, yet such is the development that 1 TW is anticipated to be the yearly ability enhancement within this years.

Within India, solar power is a method to not only help power safety and also sustainability, yet likewise assist accomplish the enthusiastic targets laid out by the federal government. India’s hostile environment adjustment dedications revealed on the worldwide phase at COP26, incorporating setting up 500 GW of non-fossil gas power by 2030, sourcing 50 percent of power needs from renewables by 2030, and also attaining web absolutely no by 2070, are anticipated to be largest motorists of future market development for solar power. On top of that, the solar community will certainly likewise open opportunities for financial development resulting in wide-scale task development.

The sustaining expense business economics and also predicted trajectory, with dropping prices therefore economic situations of growth, study and also range (R&D), and also maturation of popular innovations, offer a solid instance for solar fostering. India has actually been a strange market, where we have actually counted on imported components and also have greater rates of interest, yet have actually had the ability to accomplish a few of the most affordable tolls internationally. The vital factors have actually been large tasks, and also enhanced competitors and also optimization therefore equilibrium of system (BoS).

Trick growths with bearing upon the expense business economics of solar

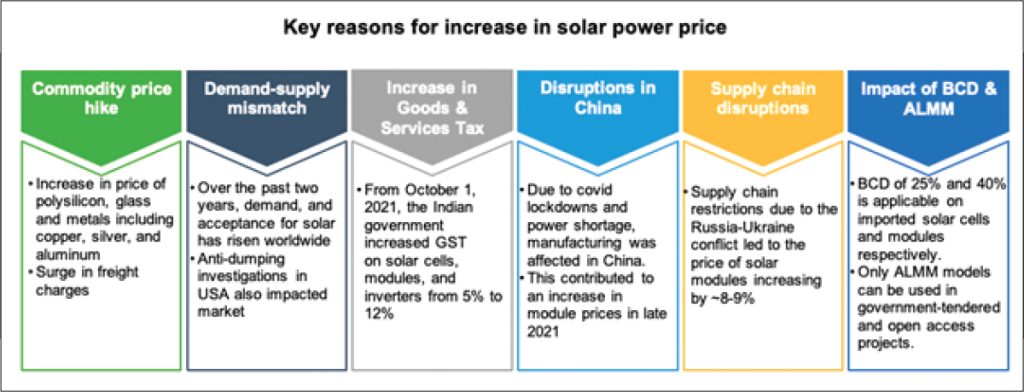

Solar energy toll had actually gone down to a lowest level of Rs 1.99 each, as uncovered throughout the 500 MW ability public auction by Gujarat Urja Vikas Nigam Ltd (GUVNL), in December 2020. The charge of a 25 percent standard personalizeds responsibility (BCD) on solar batteries and also 40 percent on components was anticipated to enhance tolls dramatically. the exploration of a toll of Rs 2.20 per system in March 2021 came as an alleviation to states. A host of Covid-related unpredictabilities, a rise in product rates, the alert of the Accepted Listing of Makers and also versions (ALMM), and also the boost in GST of 12 percent have actually resulted in a more increase in tolls. A proper sign would certainly be the Rs. 2.49 each uncovered in September 2022, throughout GUVNL’s 750 MW solar public auction.

An essential factor for these toll variations is India’s absence of self-sufficiency in solar battery and also component manufacturing. India’s solar component production ability has actually expanded from 5 GW in 2016 to around 18 GW since January 2022, that makes it among the leading 5 component suppliers worldwide. This is meagre contrasted to China. China’s top suppliers, such as JinkoSolar (18.2 GW in the initial fifty percent of 2022), Trina Solar (18.05 GW in the initial fifty percent of 2022) and also LONGi (18.02 GW in the initial fifty percent of 2022), alone delivered extra components in half a year than India’s overall manufacturing in a complete year.

To increase residential manufacturing, India has actually taken numerous actions in the direction of incentivisation (the production-linked reward (AND ALSO) system, manufacturing-linked tenders, and so on) along with defense (BCD, ALMM, and so on). The impacts will certainly show up within 2 to 3 years, when wafer manufacturing goes reside in India.

Solar component purchase alternatives and also future cost projections

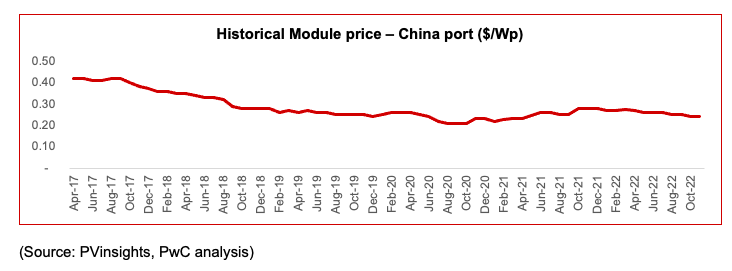

Solar components integrated with BoS comprise the power producing system of a solar energy plant. It transforms solar insolation right into functional electric power. Solar components are one of the most substantial part in a solar job and also can represent 55-65 percent of the total job expense. The vital resources for solar wafers, polysilicon, has actually gone through constant cost climbs up, as outcome has actually been reduced for a selection of factors. Solar battery and also component rates are going down and also are anticipated to drop even more in tandem with polysilicon and also various other products that enter into the production of components.

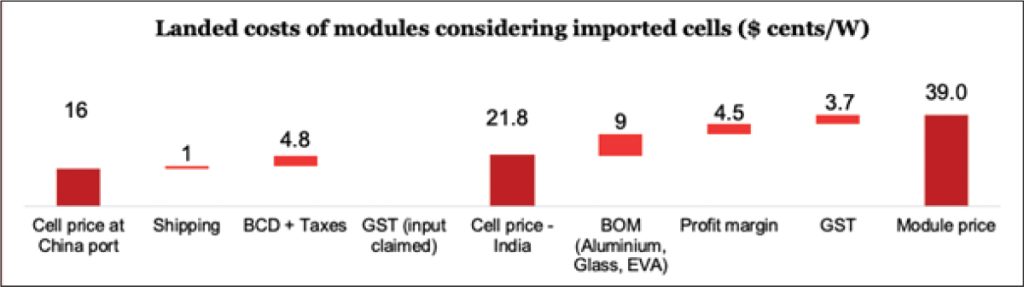

The costs of products (BoM) for each and every business is various. Solar cells are the solitary largest part in a component, accounting for 60-70 per cent of total component prices. In India, cell production is restricted, yet component production suffices. Developers, and also design and also purchase business (EPCs), have actually been importing both cells and also components for usage in solar tasks. Both vital methods to sourcing components are:

Obtaining components locally with imported cells: This is the extra widespread technique presently. Cells are imported from China, at dominating cell rates at the China port. The provided cost in India is determined after considering delivery costs, BCD and also cess. The suitable GST on cells is praiseworthy (thinking levy of GST on marketing of components), and also is therefore not determined. A cell to component BoM consisting of aluminium, solar glass, EVA, backsheet, and so on, is included, and also consequently an earnings margin and also GST of 12 percent are consisted of to approximate the landed cost of components. Cell rates differ depending upon the high quality, the amount purchased and also the shipment days. Older components might be more affordable by around 2-3 cents per Wp.

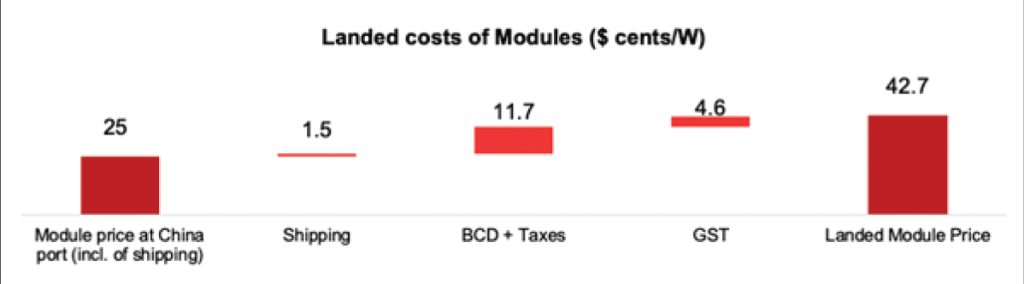

Straight-out importing components: Import of components post April 2022 brings in a BCD of 40 percent. Taking into consideration a component cost of 25 cents Wp (the existing component area cost for mono passivated emitter and also back cell or passivated emitter and also back get in touch with (PERC) components), the provided cost in India converts to concerning 42 cents per Wp message factoring in delivery costs, 40 percent BCD and also cess/taxes, and also GST of 12 percent. A GST of roughly 4-5 cents per Wp is prevented (attributed) in commercial and also industrial or EPC capex agreements. Bifacial solar components are anticipated to be valued around 0.5-1 cents per Wp, more than mono-PERC components. This setting has actually been the typical setting. With the lack of Chinese suppliers in the ALMM, there is unpredictability with respect to straight-out component imports.

As even more cell production ability obtains released, these 2 purchase settings will shed importance and also purchase will primarily occur with residential suppliers of components and also cells.

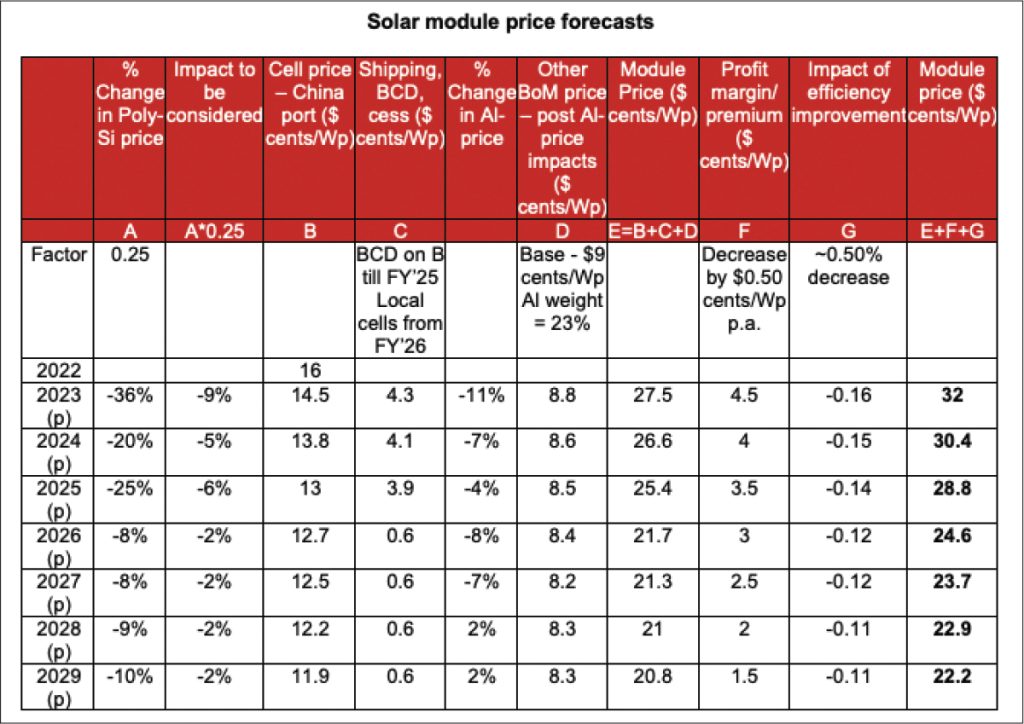

Solar component cost projections

Component setting up in India making use of imported cells will continue to be the widespread setting till brand-new cell abilities, consisting of abilities granted under the PLI system. 2 years from currently, the rates of solar batteries produced in India will be the vehicle driver for component cost decrease.

In fiscal year 2022, polysilicon rates enhanced by 166 percent and also aluminium rates enhanced by roughly 37 percent. Place rates of polysilicon have actually currently been up to concerning $32.5 per kg, and also main assessments disclose that the rates of polysilicon are anticipated to be modest in the following 2 years, securing around$ 10 -$ 15 per kg in the long-term, as was the pertinent cost before the Covid-19 closures. A cost projection of $15 per kg for polysilicon has actually been taken into consideration for economic year 2025 and also $10.5 per kg for economic year 2029 in the projection for component rates. With brand-new polysilicon abilities going reside in the coming years, there exists an opportunity of a very early decrease in rates. Solar installments have actually slowly transitioned to mono-PERC components from polycrystalline components in the last 2 to 3 years. There has actually been a renovation in component effectiveness by 0.50-1 percent on a year-on-year basis. The boost in component production abilities in India will lead to a decrease in the revenue margin( costs) billed by distributors. Better, with growth of cell production prepared, residential cell purchase has actually been taken into consideration from fiscal year 2026 onwards for projections. This will lead to cost savings on BCD and also delivery costs for cells. GST input debt will certainly be claimable as EPC cost. Or else, GST at 12 percent will be imposed on the rates anticipated right here.

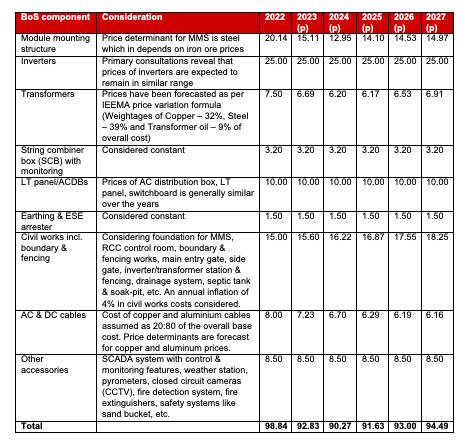

BoS and also cost projections(* )The total expense of BoS will be driven by the rates of the specific products that enter into the production of its numerous parts. With very affordable bidding process in public auctions, designer margins are being pressed, resulting in a concentrate on BoS prices to minimize funding prices. It has actually been observed over the years that as the rates of assets have actually enhanced, designers have actually selected optimization actions in making use of parts to maintain BoS prices within a specific cost array. Together with year-on-year technical improvements that drive down the rates of parts such as inverters, there is making use of alternatives in order to optimize BoS prices.

Developers imagine that BoS rates will certainly decrease in the following 2 years on the back of export tasks, and also iron and also steel products returning on-line from China and also various other manufacturers. Afterwards, on the back of the anticipated need for assets, BoS rates are anticipated to reduce or enhance. In order to take care of the rates of iron and also steel, the Federal government of India had actually enforced an export responsibility of 15 percent on steel and also 50 percent on iron ore in the recently of Might 2022, leading to NMDC iron ore rates dropping by 20-25 percent in a period of simply 10 days. Taking into consideration the lasting rising cost of living target of the Get Financial Institution of India, rising cost of living at 4 percent per year has actually been taken into consideration. The evaluation suggests that though there continues to be prospective for cost decrease with BoS, it might not be substantial.

The method onward (* )Solar power brings ecological, social and also financial advantages while displacing imported gas, adding to better nationwide power safety. Solar power has the prospective to end up being a vital factor to producing GDP, with the possibility for wide-scale work generation. The market frame of mind is mainly driven by cost business economics where changing from traditional ways to a different resource of power will certainly lead to huge economic cost savings. It is therefore crucial that solar rates proceed dropping sustainably, to allow a transformation not just in the power field yet likewise in markets such as concrete, fertilizers and also steel, where solar will certainly be required for eco-friendly hydrogen manufacturing. With wind power rates continuing to be steady, the obligation of economical continuous eco-friendly power likewise hinges on the shoulders of solar power and also battery storage space.

To allow this, policymakers require to generate even more clearness relating to need development actions and also connected rewards for production and also release. In addition to strengthened agreement and also sychronisation in between the centre and also states, there is likewise a demand to advertise not just solar production, yet likewise production of the supplementary products, tools and also equipment utilized in solar production itself.

Policymakers ought to take into consideration lasting MoUs and also critical tie-ups for essential basic materials, embark on ability structure campaigns for varied stakeholders, assistance pilot tasks and also R&D in innovative products and also equipment, work together with startups and also technical institutes to advertise residential innovation, and also job in the direction of developing a much more investor-friendly setting.