by Tom Konrad, Ph.D.

CFA The Baltic Dry Index (BDI) is a transportation and also business index developed by the London-based Baltic Profession. It determines modifications in the cost of delivering countless raw products, comparable to coal and also steel.

Due to the fact that the BDI is a procedure of the profits which firms that individual completely dry mass freight ships can make, modifications within the BDI tend to drive modifications within the stock expenses of such companies.

Stock Worth Connection

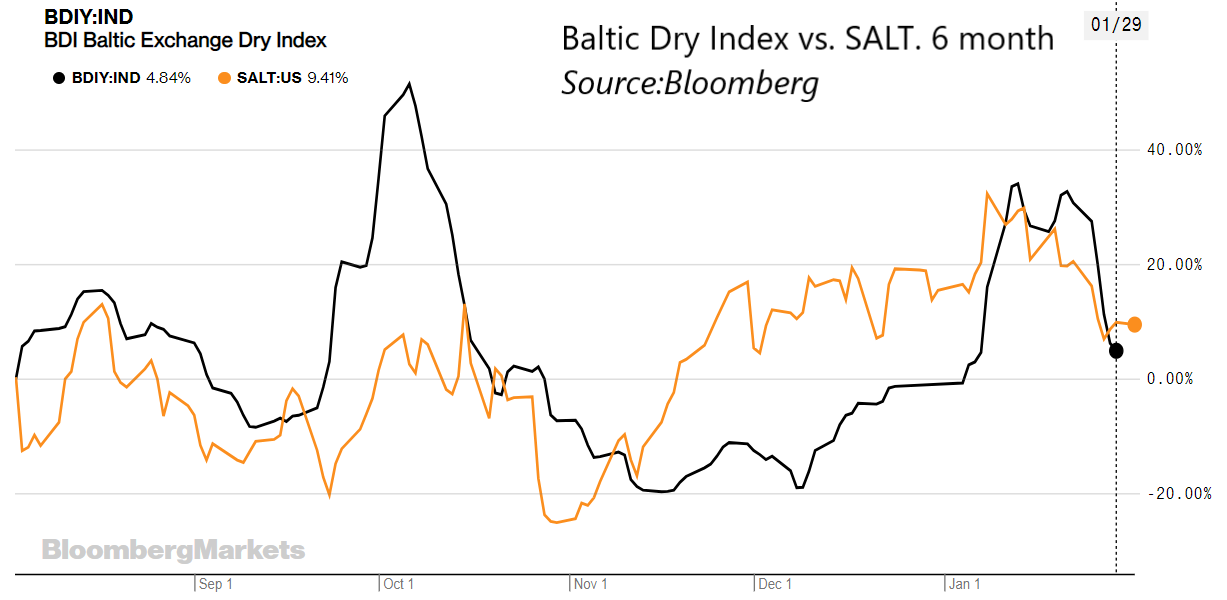

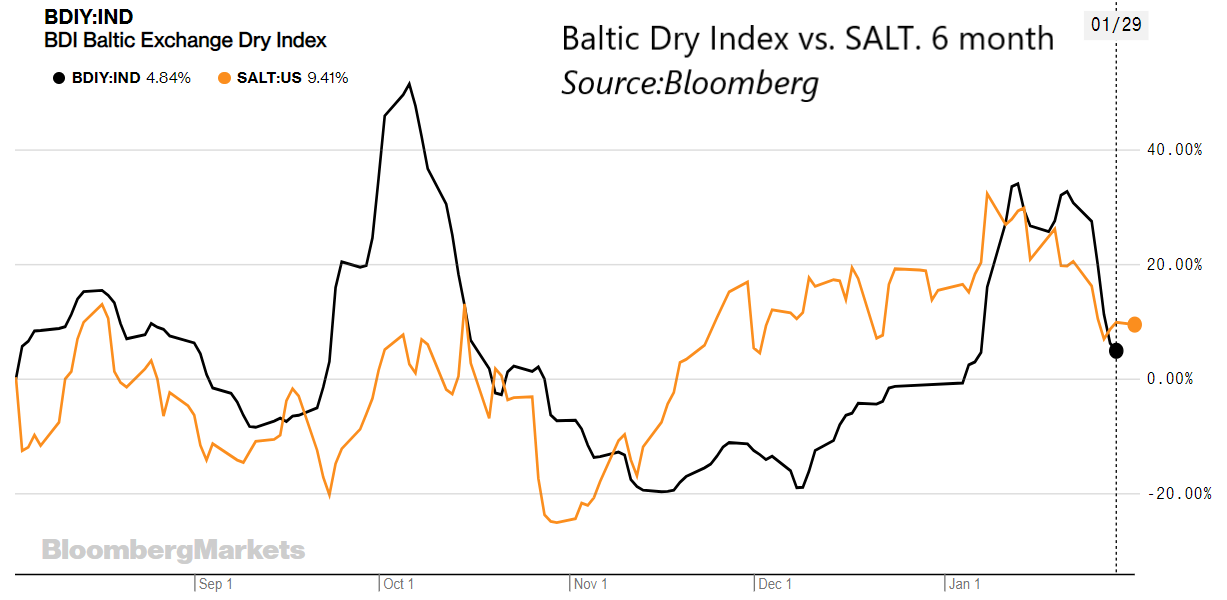

Till simply recently, one such company was Scorpio Bulkers ( SALT), absolutely among my 10 Clear Vigor Shares for 2021 choices The graph underneath displays the last 5 years, with modifications within the BDI leading to modifications in SALT’s stock worth.

There’s in addition one remarkable exemption to those associated strikes in June 2020, when the company recapitalized in an additional giving.

On August 3rd, SALT presented its brand-new method of spending within the succeeding innovation of overseas wind generator financing vessels and also advertising its fleet of completely dry mass service providers.

As SALT’s completely dry mass fleet is used, the company’s future revenues become a growing number of neutral of BDI. The connection of the stock with BDI should likewise drop over time if the market have actually been doing reasonably.

We’re not seeing that.

In October, 50-ish % strikes within the BDI brought about 25-ish % strikes in SALT. In January, we discovered 2 30-ish % strikes within the BDI, and also the equivalent strikes in SALT have actually been rounded 10 % to twenty %.

Vessel Gross sales

In each scenarios, the stock strikes have actually been approximately half the range of modifications within the BDI. In between the start of October and also the pointer of January, SALT presented the sale of twenty-two Vessels: 7 in October, 3 in November, 6 in December, and also 6 in January. The company has actually used approximately two-thirds of its fleet because brand-new method was presented on August 3rd, nevertheless the stock continues to be to be complying with the index.

Why is BDI Nevertheless Driving the Stock?

The ongoing connection in between SALT and also BDI is possibly going as an outcome of measurable bush funds making use of programmatic acquiring and also marketing to gain from relationships in between BDI and also all completely dry mass carriers. A few of these bundles (which can depend entirely on maker researching) have not however depended on day (or as much as day themselves) to duplicate SALT’s decreasing dependancy on completely dry mass transportation for its future revenues.

Timing

When a stock succumbs to reasons that do not involve its principles, I call it a searching for option.

BDI and also SALT have each dropped in late January. Enough pointed out.

DISCLOSURE: Lengthy SALT.

PLEASE NOTE: Previous effectiveness isn’t a guarantee or a reputable sign of future results. This message suits today viewpoints of the designer and also such viewpoints are subject to modify with out find. This message has actually been dispersed for informative features exclusively. Projections, quotes, and also certain details consisted of here should not be thought-about as moneying referral or an idea of any type of specific safety and security, method or financing item. Information consisted of here has actually been acquired from resources thought to be reliable, nevertheless not ensured.